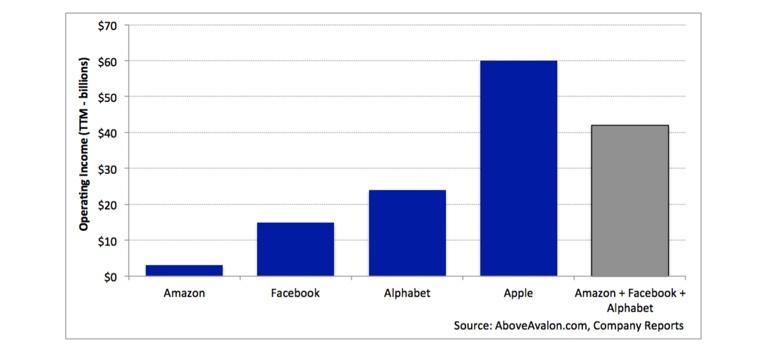

Last quarter, Apple generated almost $6 billion of free cash flow during what is regarded as its weakest quarter. When it comes to metrics such as revenue, operating income, free cash flow, and net cash, Apple dwarfs Amazon, Facebook, and Alphabet.

How does it do this?

Must read : Your next iPhone could be $100 cheaper, or $450 more expensive

Neil Cybart, Apple watcher and analyst at Above Avalon, this week published a piece called ” Apple has the best business model for generating cash” where he compared the Cupertino giant to other tech players such as Facebook, Alphabet, and Amazon.

In the metrics of revenue, operating income, free cash flow, and net cash, Apple was either bigger than, or close to equal, to Amazon, Facebook, and Alphabet combined.

So how does Apple do this? According to Cybart, it is excellent at profit extraction.

Consider Apple’s current product line:

- The most profitable smartphone

- The most profitable tablet

- The most profitable laptop

- The most profitable desktop

- The most profitable smartwatch

- The most profitable pair of wireless headphones

- The most profitable streaming TV box

Few hardware manufacturers make money selling smartphones and tablets. The money found in the components business doesn’t come close to Apple-like profitability. The best-selling laptop and desktop manufacturers can only dream of Mac margins. Apple is the most profitable wearables company. Even minor Apple products from a sales perspective, like Apple TV, are grabbing profit in an otherwise profitless industry.

And as Cybart is keen to point out, Apple isn’t overcharging customers to do this, with products such as AirPods and the Apple Watch underpriced compared to the competition, MacBooks priced in line with similarly-specced laptops, and the iPhone priced on par with Samsung’s flagship Galaxy smartphones.

So how does Apple do this? Cybart goes into great depth about this in the piece, and if you’re interested in the nitty-gritty I suggest you read the piece in its entirety, but the it boils down to what Cybart sees as Apple’s core tenets:

- Placing the product above all else – not chasing profits, not capturing data, not chasing sales, but making good products.

- Staying focused – think of how many products have come and gone in the time that the Mac, iPod, iTunes, iPhone and iPad have been around? Even if you just focus on a single company like Microsoft there are a myriad of products that have come and gone in that time (Kin, Zune, Windows Phone, to name a few). Apple, when it gets into a business, is there for the long haul.

- Relying on contract manufacturers – Apple is a design firm, and hands over manufacturing to others, allowing it to keep capital expenditures down (Apple will spend around $15 billion on capital expenditures this year, similar to what Alphabet and Amazon are expected to spend, despite having a much smaller revenue base).

Cybart goes on to examine the smart speaker market, and how Apple differs from Amazon, Facebook, and Google. While Amazon’s goal is to get cheap Alexa-powered devices into as many homes as possible in order to make money from retail sales and Prime subscriptions, and Google and Facebook will look to monetize the data obtained via low-cost microphones and cameras through advertising, Apple is looking to sell a high-priced speaker that will bring in downstream Apple Music revenue.

“Even though it may seem counterintuitive,” Cybart writes, “Apple stands to earn more cash through hardware sales at a smaller scale than companies giving away hardware at cost but looking to monetization in other ways.”

While there are doubts about Apple’s future – specifically related to what comes after the iPhone – right now there’s little doubt as to Apple’s efficiency at squeezing cash out of its product lines.

See also :