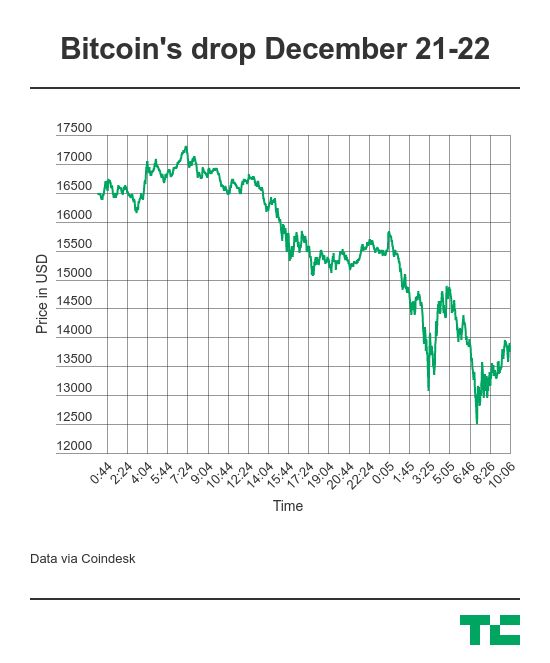

Bitcoin has been on a tear this past with the value of the cryptocurrency jumping from $8,000 to nearly $20,000. Well that run hit an abrupt end today as the price crashed as much as 23 percent on Coinbase. The price briefly dipped below $12,000 on some exchanges at around 7:30 am London time.

The drop — which wiped more than $4,000 from the value of bitcoin at one point — was the highest percentage loss of value that bitcoin has seen this year. The cryptocurrency was valued at just $998 on January 1 2017 and it soared to a record high of nearly $20,000 on some exchanges earlier this week.

It isn’t just bitcoin that has lost significant value. Ethereum (down 20 percent), Bitcoin Cash (down 30 percent), Litecoin (down 21 percent) and nearly every high-profile altcoin lost value over the last 24 hours, according to Coinmarketcap.com. Ripple was up seven percent, and just one of two coins to remain green over the past day.

What’s causing the depreciation is anyone’s guess in the same way that nobody knows exactly why bitcoin’s price has slot up from a touch under $1,000 at the start of the year — although many do attribute that to financial institutions embracing the cryptocurrency.

That’s only likely to increase in 2018. Reports today suggest Goldman is preparing to trade bitcoin and other cryptocurrencies next year.

Goldman is one of a handful of financial organizations to offer Bitcoin Futures for selected clients. CBOE was first to offer the trading option on December 10, and it has since been joined by CME. There has been opposition from some banks who expressed concern at a lack of transparency and regulation around Bitcoin Futures.

Note: The author owns a small amount of cryptocurrency. Enough to gain an understanding, not enough to change a life.

Featured Image: Bryce Durbin/TechCrunch