Apple is reportedly cutting orders for the iPhone X as demand for the pricey handset aren’t holding up despite animoji-led marketing. The big question is whether iPhone X demand matters when the only thing up for grabs is Apple’s product mix and average selling price.

Simply put, Apple can still show strong demand for the iPhone even if the iPhone X isn’t living up to high expectations as a premium device. It’s highly likely that the iPhone X price point–$999 and up–is simply driving purchases of the iPhone 8 and iPhone 8 Plus. Recall that iPhone 8 and iPhone 8 Plus sales started slow as buyers waited for the iPhone X to land.

Apple can win electronic medical record game with Health Records in iOS 11.3: Here’s 7 reasons why | Apple-based retail tech shows mobile at the core of commerce | iPhone X has the notch but this is Samsung’s solution for full-screen displays | Apple expands US capital spending, plans to add 20,000 jobs, invest in data centers

Play this out and what you have is a premium iPhone X that’ll command a healthy portion of sales with the bulk of revenue deriving from mid-tier devices. In other words, Apple’s revenue mix will resemble most companies. No other company other than Apple would be expected to sell a premium product that will account for the bulk of sales. After all, if every buyer only wanted to pay for a higher end SKU no vendor would ever make a mid-tier product.

Tech Pro Research: Interview questions: iOS developer

The guessing game about iPhone X demand has been underway for weeks. The latest from The Wall Street Journal is that Apple plans to make 20 million iPhone X handsets in the first quarter, down about half from an initial plan. Analysts expect total iPhone shipments to be up 1.5 percent for the quarter ended Dec. 31.

Here’s what’s really going on: This quarter is the first one with iPhone X in the fold. As a result, there’s a lot of uncertainty about average selling prices and product mix. Apple doesn’t even know how the upgrade cycle will play out since it hasn’t had a trio of new iPhones before.

Analysts are expecting Apple to deliver revenue of $87.06 billion in its fiscal first quarter with earnings of $3.83 a share on a non-GAAP basis.

What’s lost is the iPhone X unit consternation is that Apple’s premium device is only losing sales to its less expensive iPhones. It’s not like a customer looking at the iPhone X is jumping to Android. As a platform play, Apple can still maximize its profit on a customer via services.

Apple’s biggest problem is that the super cycle that analysts dreamed about hasn’t played out. Oppenheimer analyst Andrew Uerkwitz noted:

It appears the “super cycle” we all wanted isn’t here…$54B in free cash flow (FY18) will have to do instead…We lower our March ’18 and June ’18 iPhone shipment estimates by 10M and 8M units, respectively. We believe high price and lack of compelling features in iPhone X will keep a lower than expected number of users from switching or upgrading. We believe not even the X could break the replacement elongation cycle.

In the long run, Uerkwitz worries that Apple is headed toward stalling growth as devices transition to artificial intelligence-led features.

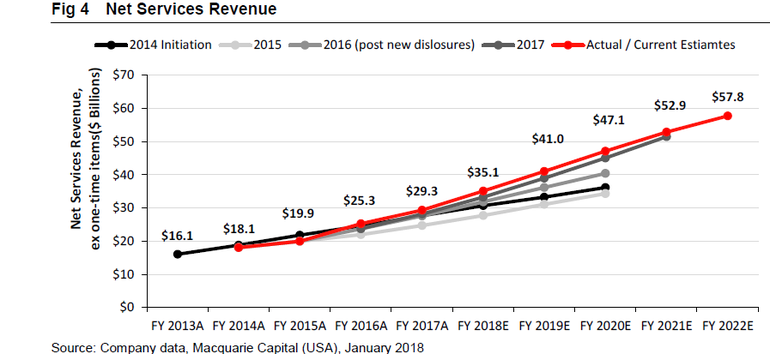

Macquarie analyst Ben Schachter recently highlighted Apple’s services revenue potential. “The bottom line is that Services and the app ecosystem will likely be responsible for a significant percentage of Apple’s future profit growth (we actually estimate over 80%). However, Apple needs to make sure that developers keep focused on the Apple ecosystem and increase the utility of apps for its users. Tim Cook’s focus on AR is clearly tied to this,” he said.

We can debate whether the iPhone X is a flop, but it may not matter as long as Apple keeps its customers in the ecosystem and buying additional services.