Following November’s overhaul of Google Pay, which saw the service expanding into personal finance, the company today is rolling out a new set of features aimed at making Google Pay more a part of its users’ everyday lives. With an update, Google Pay will now include new options for grocery savings, paying for public transit and categorizing their spending.

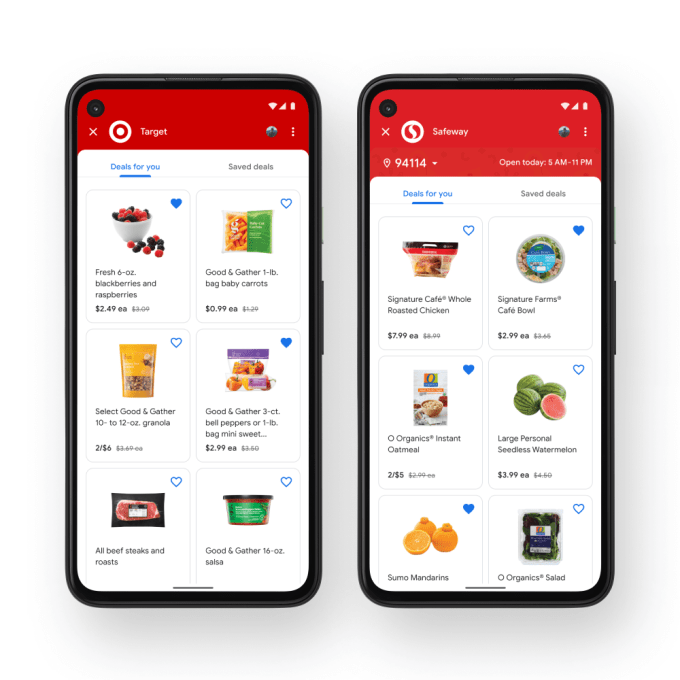

Through partnerships with Safeway and Target, Google Pay users will now be able to browse their store’s weekly circulars that showcase the latest deals. Safeway is bringing more than 500 stores to the Google Pay platform, and Target stores nationwide will offer a similar feature. Google Pay users will be able to favorite the recommended deals for later access. And soon, Google Pay will notify you of the weekly deals when you’re near a participating store, if location is enabled.

Image Credits: Google

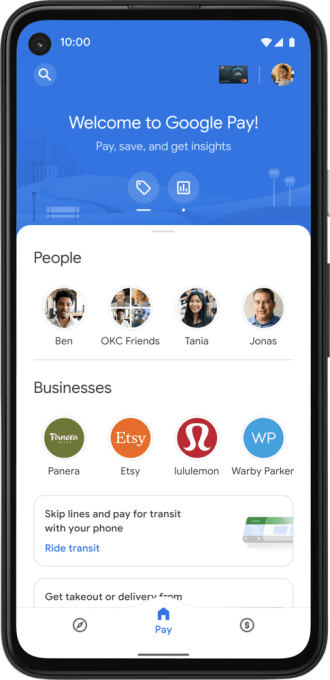

Another update expands Google Pay’s transit features, which already today support buying and using transit tickets across more than 80 cities in the U.S. New additions arriving soon now include the major markets of Chicago and the San Francisco Bay Area. This follows Apple Pay’s recently added and much welcomed support for the Bay Area’s Clipper card. The company is also integrating with Token Transit to expand transit support to smaller towns across the U.S.

Soon, the Google Pay app will also allow Android users to access transit tickets from the app’s home screen through a “Ride Transit” shortcut. They can then purchase, add or top up the balance on transit cards. Once purchased, you’ll be able to hold up your transit card to a reader — or show a visual ticket in case there’s no reader.

Image Credits: Google

The final feature is designed for those using Google Pay for managing their finances. With last year’s revamp, Google partnered with 11 banks to launch a new kind of bank account it called Plex. A competitor to the growing number of mobile-only digital banks, Google’s app serves as the front-end to the accounts which are actually hosted by the partner banks, like Citi and Stanford Federal Credit Union.

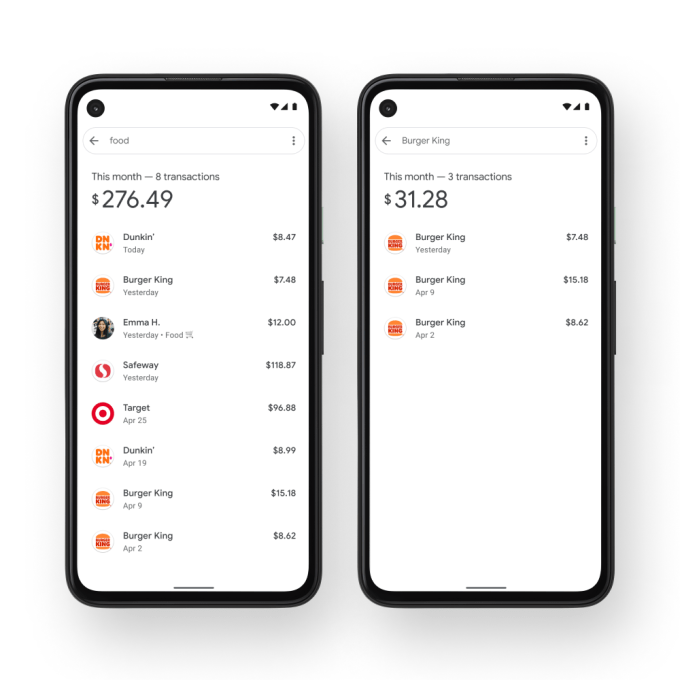

As a part of that experience, Google Pay users will now gain better access into their spending behavior, balances, bills and more via an “Insights” tab. Here, you’ll be able to see what your balance is, what bills are coming due, get alerts about larger transactions, and track spending by either category or business. As Google is now automatically categorizing transactions, that means you’ll be able to search for general terms (like “food”) as well as by specific business names (like “Burger King”), Google explains.

Image Credits: GoogleThese features are part of Google’s plan to use the payments app to access more data on users, who can then be targeted with offers from Google Pay partners.

When the redesigned app launched, users were asked to opt in to personalization features, which could help the app show users better, more relevant deals. While Google says it’s not providing your data directly to these third-party brands and retailers, the app provides a conduit for those businesses to reach potential customers at a time when the tracking industry is in upheaval over Apple’s privacy changes. Google’s ability to help brands reach consumers through Google Pay could prove to be a valuable service, if it is able to grow its user base, and encourage more to opt in to the personalization features.

To make that happen, you can expect Google Pay to roll out more useful or “must have” features in the weeks to come.