Amazon has long maintained that its video streaming service, Prime Video, helps drive more sales on the shopping app. Now the e-commerce giant is testing what happens when it brings a video streaming service directly to the shopping app.

The e-commerce giant, which launched an ad-supported streaming service (IMDb TV) in the U.S. two years ago, on Saturday launched MiniTV, an ad-supported video streaming service that is “completely free” within the Amazon India app. MiniTV is currently available only to users in India, Amazon said.

MiniTV features web-series, comedy shows, and content around tech news, food, beauty, fashion “to begin with,” Amazon said. Some of the titles currently available have been produced by TVF and Pocket Aces — two of the largest web studios in India — or supplied by comedians such as Ashish Chanchlani, Amit Bhadana, Round2Hell, Harsh Beniwal, Shruti Arjun Anand, Elvish Yadav, Prajakta Koli, Swagger Sharma, Aakash Gupta and Nishant Tanwar.

Much of MiniTV’s catalog is old-content, some of which content partners originally developed for other platforms or published on their own YouTube channels, a review found. Aspirants, for instance, is a show that TVF produced in collaboration with online learning education startup Unacademy.

“Viewers will be informed on latest products and trends by tech expert Trakin Tech, fashion and beauty experts such as Sejal Kumar, Malvika Sitlani, Jovita George, Prerna Chhabra and ShivShakti. Food lovers can enjoy content from Kabita’s Kitchen, Cook with Nisha, and Gobble. In the coming months, MiniTV will add many more new and exclusive videos,” the company added, without sharing its future roadmap plans. (Amazon quietly began integrating reviews and other web clippings — from media houses — on its shopping service in India more than two years ago.)

MiniTV is currently available on Amazon’s Android app, and will arrive on the iOS counterpart and mobile web over the coming months, Amazon said.

Amazon’s move follows a similar step by Walmart’s Flipkart, the company’s marquee rival in India, which rolled out video streaming service within its app in 2019. In recent years, scores of firms in India including Zomato and Paytm have explored adding a video offering to their own apps.

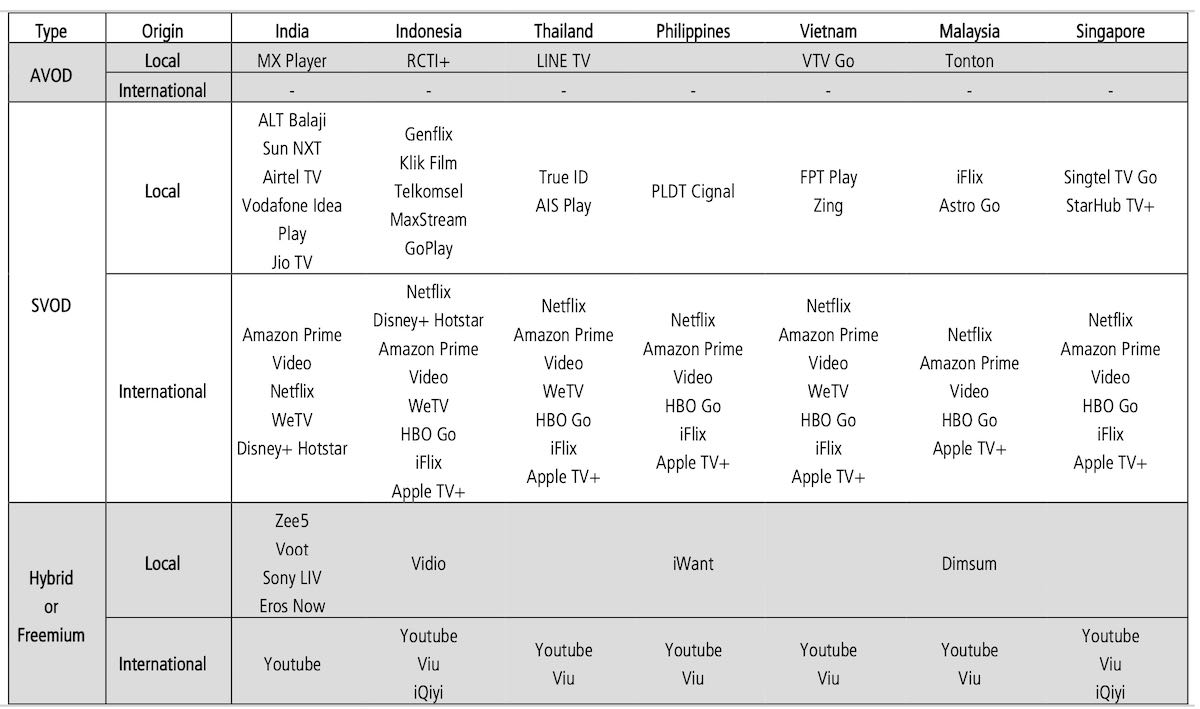

The video streaming landscape in “N2B” countries — the nations with potential to help firms find their next two billion users. (UBS)

Amazon has also aggressively pushed to expand its Prime Video offerings in India in recent quarters.

The company — which recently partnered with Indian telecom network Airtel to launch a new monthly mobile-only, single-user, standard definition (SD) tier (for $1.22) — has secured rights to stream some cricket matches in the country. Amazon also offers Prime Video as part of its Amazon Prime subscription in India. The service is priced at 999 Indian rupees ($13.6) for a year and also includes access to Amazon Music and faster-delivery.

Prime Video had over 60 million monthly active users in India in April, ahead of Netflix’s 40 million users, according to mobile insight firm App Annie (data of which an industry executive shared with TechCrunch). Netflix, which spent about $420 million on locally produced Indian content in 2019 and 2020, said in March that it will invest “significantly more this year” in India. In the company’s recent earnings call, founder and co-CEO Reed Hastings said investment in India was more “speculative” than those in other markets.

Times Internet’s MX Player, which also operates an ad-supported streaming service, had over 180 million users during the same period, and DIsney+ Hotstar had about 120 million users. Their biggest competition in India remains YouTube, which has amassed over 450 million monthly active users.

But other than competition, video streaming services face another challenge in India. In late March, Amazon issued a rare apology to users in the South Asian nation for an original political drama series over allegations that a few scenes in the nine-part mini series had hurt religious sentiments of some people.

Amazon’s apology came days after New Delhi announced new rules for on-demand video streaming services and social media firms.