Carl Icahn, one of Apple’s biggest activist investors, told CNBC he has exited his position in the company.

He was known for basically trying to pressure Apple into bumping up its efforts to return value to investors. At the time he declared his position, Apple was in the process of a $100 billion several-year capital return program that included buybacks and dividends, but that wasn’t enough for Icahn, who pressed the company to return more of its massive cash pile (of which the company now has a mind-boggling $233 billion).

All this was enough to get Cook’s attention — who ended up having a conversation with Icahn, the activist investor said. That’s usually the case with any activist investor, as activity like this can stir up some concerns over whether or not shareholders will start agitating for a change in strategy. Icahn frequently stated that Apple shares were undervalued.

Icahn at one point owned a little less than a 1 percent position in Apple — which may not seem like much, but for a company worth hundreds of billions of dollars, it represents a significant amount of cash at stake. Icahn told CNBC he made around $2 billion off his position in Apple, a stock he still called “cheap.”

And cheap indeed — Apple shares fell off a cliff after its last earnings report, where it showed a decline in revenue for the first time in 13 years. Apple’s core growth engine, the iPhone, has started to slow, as the company sold around 51.2 million iPhones compared to 61.2 million in the same quarter a year earlier. Greater China in particular started to slow significantly, and the country’s attitude toward Apple largely drove him to shed his position, he told CNBC.

Still, with Apple’s share price continuing to decline — now down 23 percent on the year — you have to wonder whether or not this will attract the attention of other parts of Wall Street, which could scoop up big shares of the company and also look to find ways to pressure Apple into delivering more of its cash back to shareholders.

Shares of Apple fell an extra 2 percent in trading today.

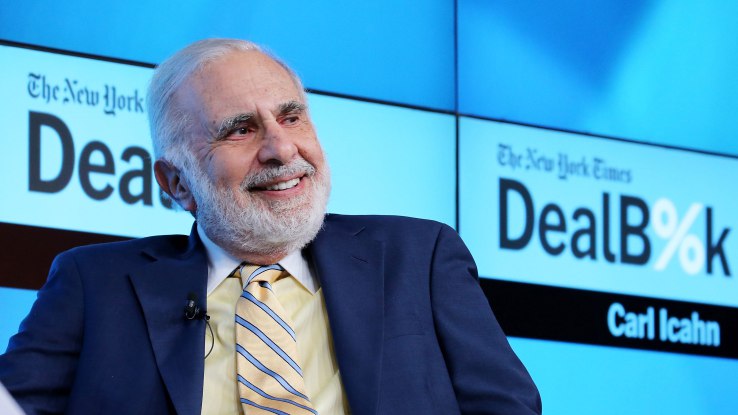

Featured Image: Neilson Barnard/Getty Images