Jason Cipriani/CNET

A couple of weeks before Christmas, my family and I went on a trip to Universal Studios and Disney World in Orlando, Florida. We had originally had the trip scheduled for spring break 2020, but then the pandemic forced both parks to close. Even though we were all disappointed by having to reschedule the trip, I’m glad we were able to eventually make it.

It was during this trip that my wife and I decided to give all three of our children complete and total financial freedom over the personal treasure chest of funds they’d been collecting for this trip.

Neither of us was comfortable handing over a stack of cash and hoping that they didn’t lose it or spend it all without any sort of accountability. During our conversations about how to best facilitate their newfound freedom, I remembered seeing a pop-up in the Wallet app on my iPhone mentioning Apple Cash Family.

My kids are all old enough to have a phone. Well, one of them is old enough to have an Apple Watch that I manage and can track on my iPhone. The point is — all three of my kids have some form of Apple device that works with Apple Cash and Apple Pay.

As I started to research Apple Cash Family, the more it made sense for us to test out during our trip. After finding the proper settings to turn on (more on what those are in a minute), I activated an

Apple Cash card

on each of my kid’s devices. Doing so effectively put a debit card directly on their iPhones and Apple Watch that they could use at any payment terminal that accepted contactless payments. Which, thankfully, is pretty much all of them.

I’m able to see their current balance and where they’ve spent money, including push alerts the moment a transaction goes through. I can even control who they can send money to through iMessage.

Before I go into more details about how the experience went and where I’d love for Apple to make some changes, let’s go through what you need to do to get Apple Family Cash up and running for you and your loved ones.

What you’ll need to do before setting up Apple Cash Family

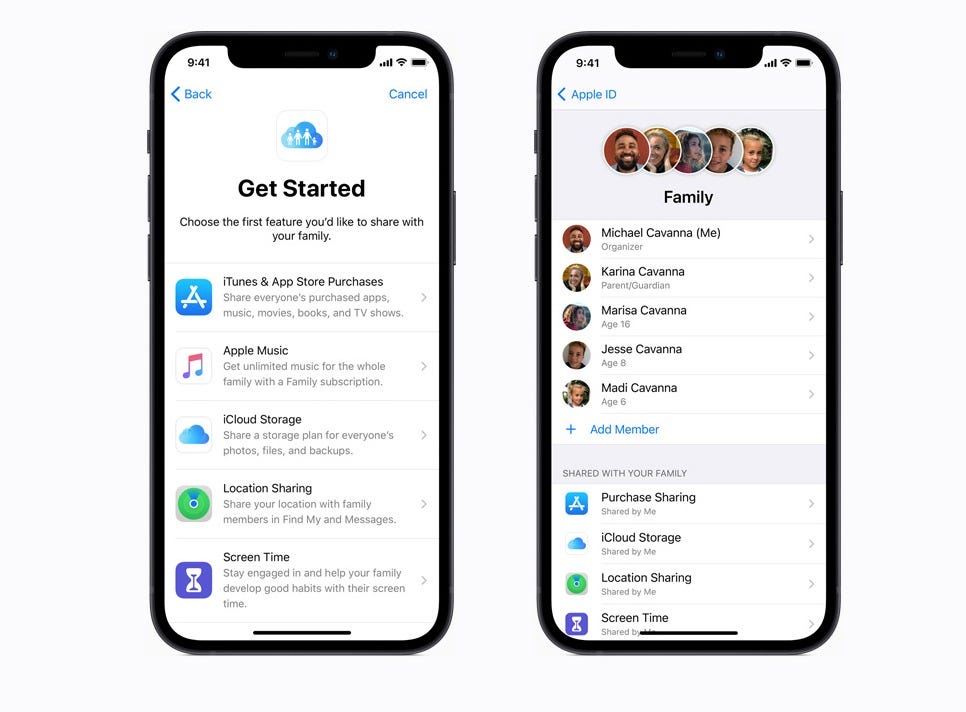

Image: Apple

One of the requirements of using Apple Cash Family is that you have Family Sharing set up and all of your children added to your family group. The benefits of setting up Family Sharing go far beyond monitoring your kid’s spending habits and include being able to share app purchases, iCloud+ storage plans or an Apple One subscription for all of Apple’s services. Oh, and you can use Apple’s Screen Time to manage your child’s device.

It takes a few minutes to get it all set up, but it’s well worth the investment. This Apple support page walks you through the process of creating a family group and then adding your kids and your partner to it.

You can have a total of six people in a Family Sharing group.

Naturally, you all need to have some form of Apple device that works with Apple Pay. That means an iPhone or

Apple Watch

an iPad

won’t work.

Oh, one more thing — your childrens’ accounts will need to have two-factor authentication (2FA) enabled for their Apple ID.

How to activate Apple Cash Family

The first time you visit this Settings page, you’ll need to go through a few extra steps.

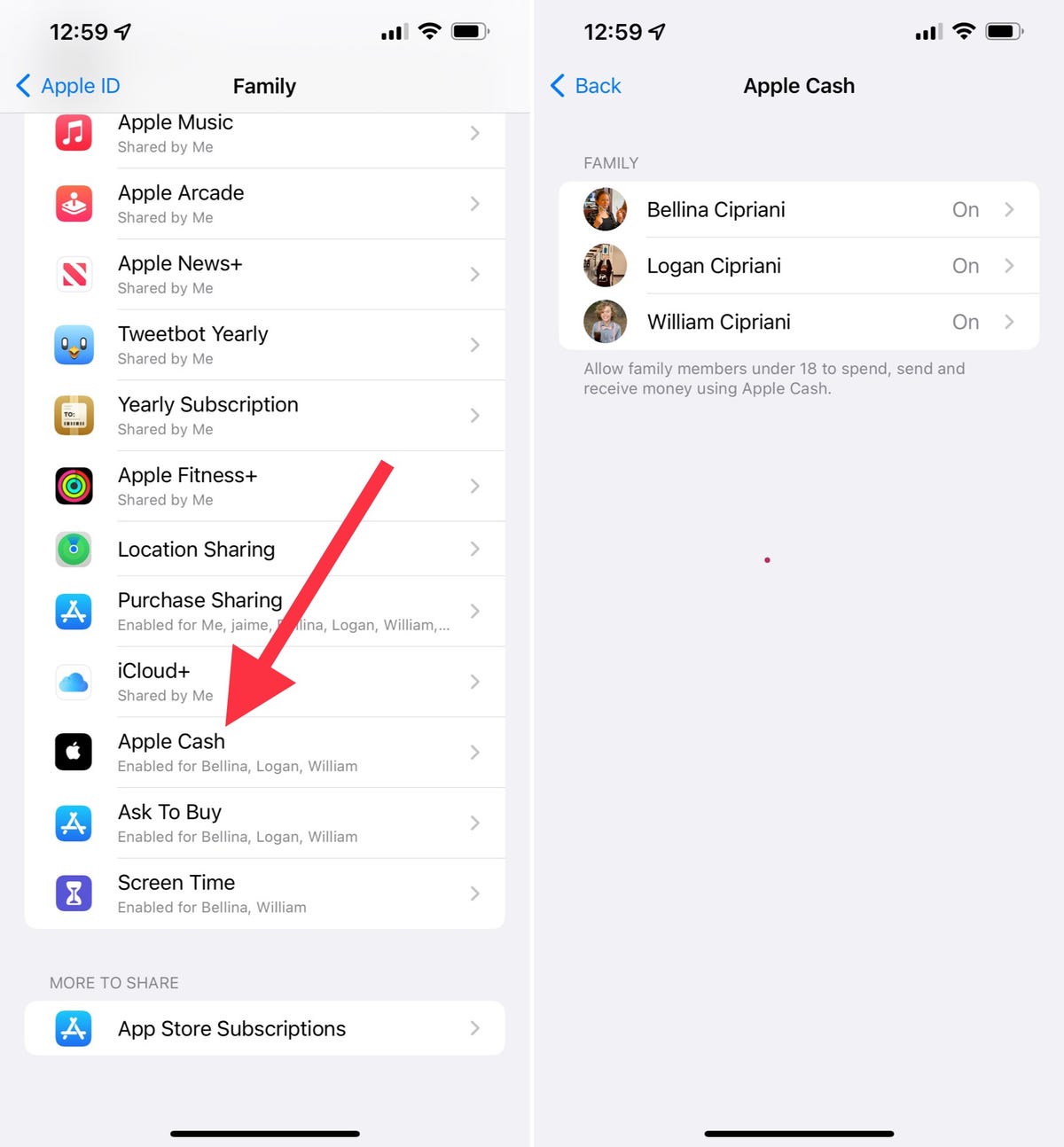

Screenshots by Jason Cipriani/ZDNet

Once you have Family Sharing set up, you’ll need the family organizer to activate the Apple Cash integration. To do that, open the Settings app on your iPhone, tap on your name at the top of the screen, then select Family Sharing. Scroll down until you find Apple Cash; tap it.

I can’t recall the specifics of the next few steps, but I do remember having to verify my identity and then wait for each card to be added to their account. The entire process took maybe 5 minutes.

If you see a Pending message next to a child’s name, double-check that you have 2FA enabled for their Apple ID and that they’re using a compatible device.

Once the cards are added to their account, you’re given an option to send them money which opens the Messages app with Apple Pay open and ready for you to enter a dollar amount.

If you’ve ever used Apple Pay to send someone money, you’re already a pro at adding money to your kid’s Apple Cash card.

How to view, manage and control a child’s Apple Cash card

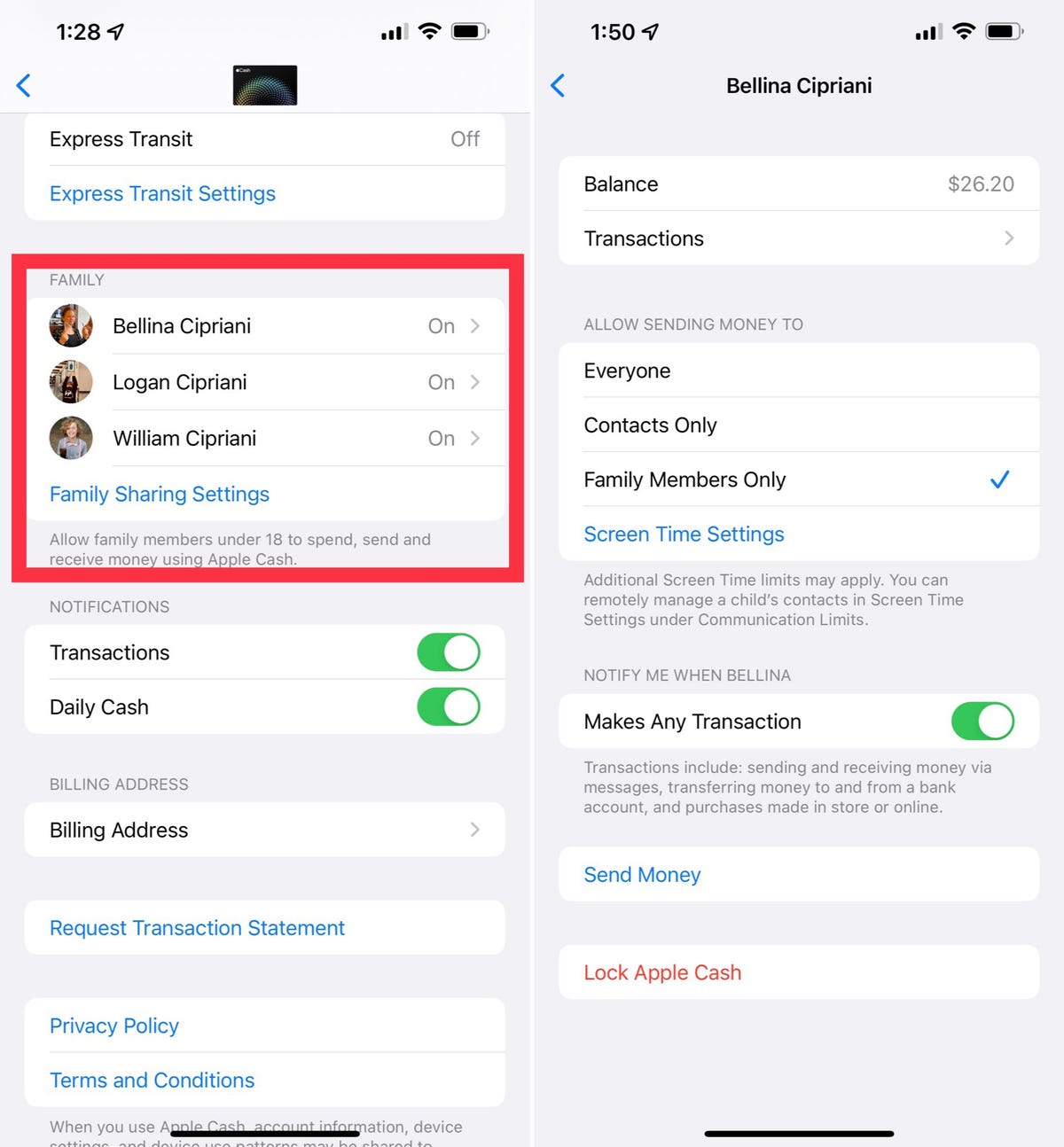

Screenshots by Jason Cipriani/ZDNet

Alright, cool. Now your kid(s) has an Apple Cash card and money loaded on it. Now your child can use their Apple Cash card anywhere you can use contactless payments. For iPhone users, that means double-pressing the home button (on older iPhone models) or double-pressing the side button to open Apple Pay. The Apple Cash card should be the default payment method — hold the top of the iPhone near the payment terminal, or for Apple Watch owners, you’ll need to place the screen of your watch near the payment terminal’s contactless payment section.

But you’re not left to let them spend freely without any type of supervision or input. You’ll want to spend a few minutes going through your kid’s Apple Cash Family settings to ensure that each one is set up to your liking.

You can either follow the steps outlined in the last section by going through the Settings app to make changes, or you can open the Wallet app on your iPhone. Next, select your Apple Cash card and tap on the three-dot icon in the top-right corner.

Scroll down until you get to the Family section where you’ll see your kids listed. Tap on each child to view their respective settings.

Here you can view their current balance, dive deeper into their transaction history, control who they can send money to, turn transaction notifications on or off, or — and this one is my favorite — lock their Apple Cash card to prevent them from using it at all. Note that this won’t disable the card or feature, but it will keep them from spending any money.

The end result: We’re never looking back

Hogwart’s sure was impressive all lit up at night.

Jason Cipriani/ZDNet

Once my wife and I explained to our kids that they would be in full control of their money during our trip, I could see the excitement light up in their eyes. They could, without a parent around, walk into a store, pick something out, go to the register and buy it all on their own. I was excited, but admittedly somewhat nervous, about how well it would work out, and more importantly, I was worried they would spend all of their money on day one.

At the airport, before we boarded our flight to Orlando, we agreed that they should all make a test purchase with my wife and me by their sides so they could experience the process. There was a slight learning curve for all three of them, but I think that was more nerves than anything.

Over the course of the next week, my kids didn’t have to ask if they could go buy a butterbeer while we waited in line next to Hogwarts. Nor did they have to ask if they had enough money left to buy a Harry Potter hoodie they’d found. They were able to open their Apple Wallet app and see their Apple Cash balance in real-time.

I would receive an alert on my iPhone with each purchase. If I opened it, I could see more transaction details, and even see their account balance.

Our youngest child, who is 10, said that he felt like a grown-up whenever he bought something. Although, he did admit that one checkout clerk looked at him with a curious expression as he placed his gift shop haul on the counter and waited for her to finish scanning. In his words “She kept looking around me like she was waiting for my parents to show up.”

To my surprise, all three of our children came home without having spent half of their original balance. It’s as if seeing how much money they had and being forced to do the math about the impact their next purchase would have on their balance was a deterrent. I can all but guarantee if my wife and I were in charge of their money during the trip it would have been all but gone. It’s easier to spend when you don’t have a way of holding yourself accountable. In this case, seeing a living balance adjust with each purchase is that accountability.

I do wish that Apple would make a couple of small changes to how Apple Cash Family currently works. I would love for my wife and I to both have access to their settings and the ability to receive push alerts for balance changes. Right now, only I can see those things.

I also would love an option to prevent people from sending my kids money. I mistakenly thought that’s what the current settings prevented — who my kids could send or receive money from. But, as I learned just last week when an overeager grandparent sent my kids each $20 as a “test” to see if it would work, I was totally wrong. Right now, I can only limit who my kids can send money to. My kids, however, would appreciate Apple leaving the settings just as they are.