Twitter’s stock is cratering this week following its earnings report on Tuesday, down around 15% and shaving more than a billion dollars off its market cap — again.

This isn’t even an all-time low for Twitter. But the company is a long, long ways from its successful run after its initial public offering. At the time, Twitter was showing — while slow — user growth and that it was doing a decent job of monetizing its user base. Twitter’s advertising products appear to be, at the very least, effective. Here’s the company’s revenue scorecard:

- First quarter, 2015: $436 million, up 74% year-over-year.

- Second quarter, 2015: $502 million, up 61% year-over-year.

- Third quarter, 2015: $569 million, up 58% year-over-year.

- Fourth quarter, 2015: $710 million, up 48% year-over-year

- First quarter, 2016: $595 million, up 36% year-over-year.

But here’s the hard one: the company is expecting revenue between $590 million and $610 million in the second quarter this year. That’s way below what analysts were expecting (around $678 million), and the company isn’t growing its revenue as fast as industry watchers were expecting. This quarter, the culprit was that brand marketers did not increase spend as quickly as expected in the first quarter, according to the company.

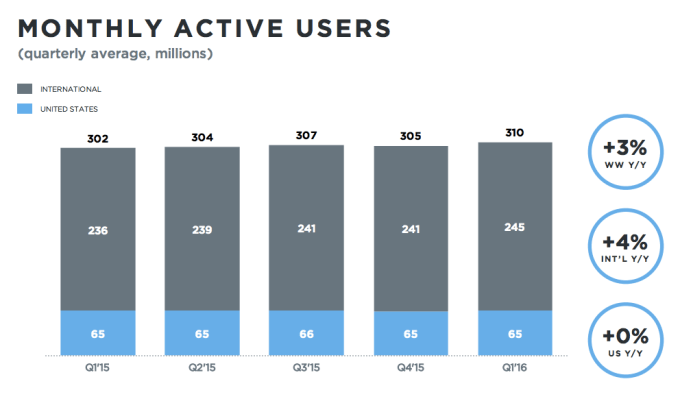

Twitter hasn’t shown that it can be a massive growth company like Facebook (or, at least historically, Apple) — at least, not yet, even despite the service’s users growing quicker than what was expected this quarter. It has to show that it can grow on multiple fronts now, if not all: user growth, revenue growth, new products and better advertising products.

So despite stronger-than-expected (but still slim) user growth, revenue isn’t expected to grow as quickly as industry watchers were expecting — and that’s a big problem for the company. So naturally, this happened:

For Twitter to show that it can be a strong, independent public company, it has to convince investors that it can continue growing at a good clip. Twitter has been releasing a slew of changes and new products, such as a big change to its timeline (switching to one that’s more algorithmic) and new real-time services like Moments. And it’s trying to make the service less confusing and more palatable to new users. The question, now, is whether all that is working.

But, even as it improves its advertising products and releases new parts for its portfolio of apps, there’s still an upper bound to what it can do with its revenue as long as its user growth continues to grow slowly. Last quarter, Twitter’s user base actually fell quarter-over-quarter — a big moment for the company. For a while (circa its IPO, basically), Twitter looked like a strong growth company on both a revenue basis (which it still, for the most part, is!) and a user count basis (which, even while it was slow, was still going up).

This quarter, user numbers were back up — from 305 million to 310 million. That’s actually a better add than its last couple of quarters. But if it’s not going to grow at a strong enough rate to outpace the company’s ability to create new revenue-generating products and improve its advertising targeting to increase that business, then that’s going to be a problem for the company going forward. Again, Twitter has to increase the number of heads it can inevitably monetize, whether that’s through its developer network or its core Twitter users.

Basically, Twitter has to show Wall Street that it can continue to grow — which is even the case for large companies like Apple and Alphabet. Apple got hammered after its recent earnings report because it reported the first sales decline in 13 years, and its forecast didn’t look that much better. Apple, suddenly, was no longer a massive growth company with its core growth engine — the iPhone — beginning to stall.

All this leads back to Twitter’s ability to, eventually, return value to investors. It’ll eventually have to deliver on a big capital return much like Apple eventually did. Wall Street (and in particular activist investors) can exert pressure on the company to do just that — and force other events like board shakeups, much like what happened to Yahoo this morning. As Twitter’s shares continue to decline, it’ll become easier for activist investors to snap up increasing control of the company and force it to take action that fits their agenda. Twitter, unlike Apple, doesn’t have a monster market cap and could be more vulnerable to that kind of activity.

There are a couple ways to insulate against this activity — Facebook, for example, plans to institute a new class of stock that keeps CEO Mark Zuckerberg in control of the company as he transfers his wealth to a new entity geared toward investments in positive efforts like education. But could Twitter get away with something like that? Tough to say, because all this would have to go through shareholder approval, and that requires confidence in the company. Twitter, however, does have some protection here: board members can issue preferred shares, giving it the ability to protect itself to an extend from activist investors.

But it’s going to be a tricky road for Twitter. Another big downside to Twitter’s inability to keep its stock price up is that it’s going to be tougher to recruit good talent, which sometimes have compensation packages that include stock. That can quickly become a self-fulfilling prophecy: without good talent, good products might not materialize, user growth continues slowly, and the stock gets hammered again. And then the whole process repeats itself.

So, what can the company do to stave off Wall Street in general? Basically show more growth, in more areas, and prove to Wall Street that it has an engine that will propel the company to generate more revenue, become more profitable and return more value to investors. And it’s going to have to, once again, innovate in order to get more heads in the room that it can monetize and improve that monetization engine.

So far the company has been very bullish on Periscope as one of its core new products that’s around its live-centric focus, but we haven’t seen strong monetization materialize from that product just yet. Twitter also recently signed a deal to live-stream Thursday Night Football, something that could bolster its efforts in producing more live content. It’s still early days there, and already the company is going to face stiff competition from things like Facebook Live — which can tap into Facebook’s billion-plus user base.

There’s also its developer network, which represents a new potential front for advertising revenue. If it can convince developers to tap into its advertising products like MoPub, it can find a new way to generate a new line of advertising revenue — which can help convince investors that it’s still able to create new products that will help the company continue to grow. Still, that’s early days, but the company is making a big bet on it.

In short, Twitter has a lot of work ahead if it wants to keep Wall Street happy — and off its back.

Featured Image: Bryce Durbin