Amazon posted its first-quarter earnings today, and boy did they not disappoint: it beat what analysts were expecting on nearly all fronts, and the stock is up more than 12% after its huge beat.

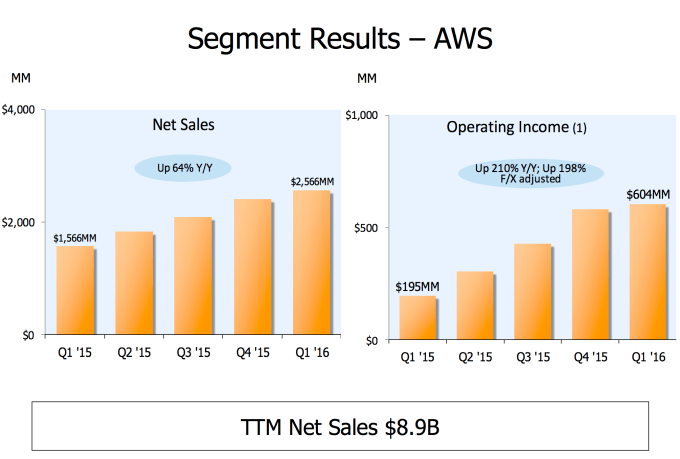

The big one here, in particular, is Amazon Web Services. AWS has become a go-to for most businesses, so it’s not surprising that it’s seeing that segment continue to grow steadily. The company is posting huge year-over-year growth here, meaning that demand is still increasing, despite increasing competition from companies like Google and Microsoft. More and more, it looks like AWS is going to be a huge second line of business for the company, especially if it continues to grow at this rate. For the trailing twelve months, it’s about a $9 billion business.

It’s always impressive for a company that, for most of its lifetime, has been focused entirely on its commerce side is able to grow a new business from scratch, given that other larger technology companies are also throwing concepts at the wall looking for new lines of business. For Facebook, it’s VR and services like WhatsApp. For Google, it’s the company’s moonshots like self-driving cars. These have yet to come to fruition, while AWS is showing that it’s becoming a real business.

Even more interestingly, Amazon’s AWS division posted an operating income even higher than its core business in North America. The company said AWS posted an operating income of $604 million, compared to operating income of $588 million in its core business in North America. This is a business that, while generating less than its e-commerce business, seems at first blush operationally more efficient and still growing at a health rate. Bezos himself said that he expects AWS to be a $10 billion annual business in his 2015 letter to shareholders.

Here’s the scorecard:

- The company reported earnings of $1.07 per share, ahead of 58 cents per share that were expected. The company posted a net loss of 12 cents per share in Q1 2015.

- Revenue was $29.13 billion, ahead of what $27.98 billion that analysts were expecting, and up 22% from the same quarter last year.

- Amazon web services revenue was up to $2.57 billion — ahead of the $2.53 billion that analysts were expecting. That’s up from $1.57 billion in the same quarter a year ago, a jump of about 64%.

- The company sees Q2 revenue of $28 billion to $30.5 billion.

- Unearned revenue came in at $3.77 billion, up from $3.12 billion in the previous quarter.

- Technology and content revenue was $3.5 billion, up from $2.8 billion in Q1 2015.

- International sales of $9.6 billion, up from $7.8 billion in the same quarter a year ago.

So the company is over-performing compared to what everyone expected in nearly every category. Amazon is expanding into tons of new markets, like video streaming and expanding its web services business, and of course it has its $99 per year Prime subscription. The company is also increasing its portfolio of devices with the Fire TV and the Amazon Echo.

What’s going on here with the stock? Basically, Amazon shares tend to swing wildly whenever it reports earnings. Last quarter shares tanked 13% after missing fourth-quarter expectations. The year in general has been a rocky one, though it’s been one of the better-performing stocks of the year (it’s up 42%). So it’s not surprising to see such a big swing off today’s earnings after it posted such a successful quarter.

One big one investors are looking at is directional information about the company’s Amazon Prime memberships. In theory, making it easier/cheaper to deliver things should convince customers to buy more, outweighing the increased shipping costs that the company would sustain. This, in theory, falls under unearned revenue, which appears to be ever-increasing.

There’s another big trend this earnings report establishes: Amazon has posted a profit for four quarters straight. The company has historically been pretty blasé about focusing on profit, instead investing entirely in growth and showing losses on a regular basis, but the company now appears to be turning its business into a profitable machine (or at least, focusing on that to some extent).

As usual, Amazon didn’t break out any new numbers for its hardware devices — despite launching a new Kindle (the Kindle Oasis) and two new Amazon Alexa-powered devices.

As usual, Amazon didn’t break out any new numbers for its hardware devices — despite launching a new Kindle (the Kindle Oasis) and two new Amazon Alexa-powered devices.

Featured Image: Eric Broder Van Dyke/Shutterstock