What growth there is left in the smartphone market continues to center on emerging markets where consumers are upgrading from feature phones.

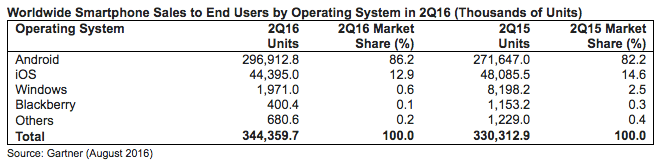

And that ongoing transition is helping boost Android’s global marketshare, which Gartner pegs at 86.2 per cent in Q2 in its latest mobile market figures.

But the analyst says Android is not just winning buyers at the mid- to lower-end smartphone segments in emerging markets — with sales of premium smartphones powered by Android up 6.5 per cent in Q2 too.

Gartner points to premium devices from key Android OEMs, such as Samsung’s Galaxy S7, as helping to lift the platform’s fortunes at the high end, along with affordably priced premium smartphones from Chinese OEMs such as Huawei and Oppo.

It notes Samsung improving its own performance too, clawing back some marketshare it recently lost in emerging markets to take a 22.3 per cent slice of sales in the quarter, vs 8.9 per cent for Huawei and 5.4 per cent for Oppo. Xiaomi fared less well, losing share in the quarter.

Meanwhile, on the platform front, Apple’s iOS shed nearly two percentage points, sliding from 14.6 per cent in the year ago quarter to 12.9 per cent. Only Microsoft’s Windows smartphone platform saw a worse decline.

Overall, Gartner said smartphone shipments grew 4.3 per cent in the second quarter of 2016, year over year. It pegs global sales of smartphones at 344 million units in the quarter.

With smartphones winning over more buyers in emerging markets sales of feature phones were down 14 per cent in the quarter, which Gartner said contributed to a drop in overall sales of mobile phones during the quarter.

All mature markets except Japan saw slowing demand for smartphones during Q2, according to the analyst, while all emerging markets except Latin America saw growth in smartphones. Smartphone sales in the latter regions were up by 9.9 per cent vs a 4.9 per cent decline in mature markets.

Gartner notes that the top five smartphone manufacturers collectively continued to gain market share in the quarter — up from 51.5 per cent to 54 per cent year on year — with the biggest individual winners being Oppo, Samsung and Huawei.

Apple’s smartphone marketshare declined 7.7 per cent, year on year, with the worst sales decline in Greater China and mature Asia/Pacific regions — where iPhone sales dropped 26 per cent.

Conversely, the iPhone’s best performing regions in Q2 were Eurasia, Sub-Saharan Africa and Eastern Europe, where sales grew more than 95 per cent, year on year.