Whether you’re working out of a dorm room or running a billion-dollar company, a little pivot can go a long way. At their worst, pivots can derail a company’s success, but at their best, they demonstrate a company is still attuned to its user base — no matter how big it gets.

Digit, a fintech service that helps people save, launched a year and a half ago with the hypothesis that the key to incentivizing savings was simplicity. The company dropped a nifty SMS tool to proactively inform users of their spending habits and nudge people to save. While it’s true that simplicity is important, it turned out that people didn’t feel very in control of their money over a platform as colloquial as text messaging.

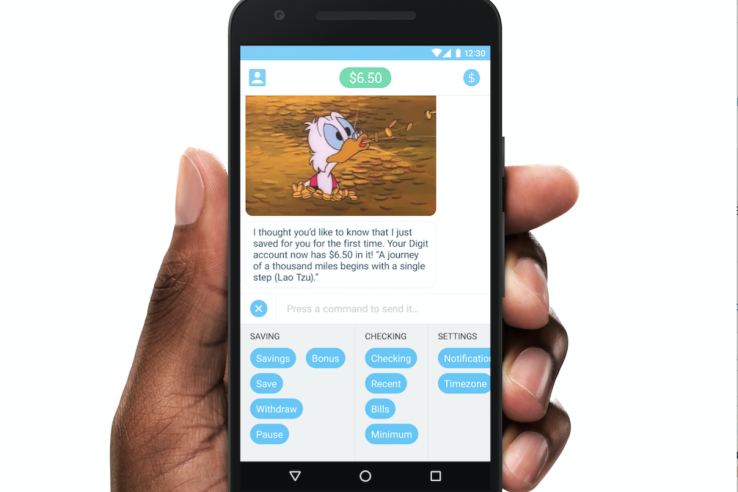

To address this problem, Digit launched an iOS application that rapidly grew to account for half of all users. Today, the company is taking the next step by launching an Android version of their service as well. As we previously covered, Digit connects to your checking account and analyzes personal cashflow to optimize savings.

When we spoke with Digit CEO Ethan Bloch, he said he expects the number of users accessing Digit through their mobile app to grow to 90 percent in the coming months. The premise is an interesting one with a number of fintech services taking sides between in-app and out-of-app offerings.

Mobile payments company Boku for example raised $13.75 million in funding last week to facilitate transactions for digital goods and services outside of an application. Users input their mobile phone number to pay for goods directly. People are comfortable processing “hundreds of millions of transactions” on the platform, but Digit has been discovering that all of that changes when the transaction moves from spending to saving.

Bloch gives an explanation rooted in behavioral science to explain why his Digit savings service works better through a mobile application. Bloch noticed that engagement was double in the mobile application. He explained this data point by saying that users want to feel their money is cordoned off and protected. Fundamentally there is nothing different in how money is managed on an SMS service or one run through a mobile app. However, an app provides the illusion of separateness, a private place users can check their balance. And while it may seem silly, small details like this matter in the real world.

The shift seems to be working as the company has grown to manage $30 million in savings every month, up from the $20 million we reported back in June. The 19 person company is projecting $360 million per year in facilitated savings.

Interestingly, the iPhone user demographic is wealthier than that of Android, so the new application will make it easier for everyday Americans to use Digit to manage their cashflow.

“Android gives us a more normal distribution of the working population, and a better sense of the economic fate of the country, including more people who have trouble making ends meet each month,” said Bloch

In the coming months, Digit will be focusing its financial resources on developing new features in their product roadmap. The company has raised over $36 million in funding from GV, General Catalyst, Ribbit Capital, and Baseline.

The new app is available from the Google Play store starting today for Android 4.1.2 and higher. Even with the new app, customers can continue to receive financial updates via SMS if they so choose.