With Twitter’s acquisition hopes essentially dead, the company now seems it’s on its own to fend for itself and needs to figure out a way to build a reasonable and profitable business.

Today, it got a much-needed good Q3 performance by largely beating Wall Street’s expectations across the board. The company also confirmed that it would lay off roughly 9 percent of its staff as it looks to restructure itself into a company that can continue to run on its own and keep Wall Street happy. Those layoffs are targeted at sales, marketing and partnerships, the company said, confirming an earlier TechCrunch report.

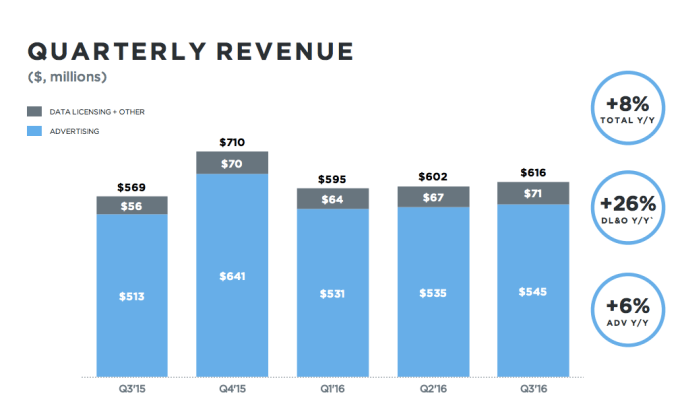

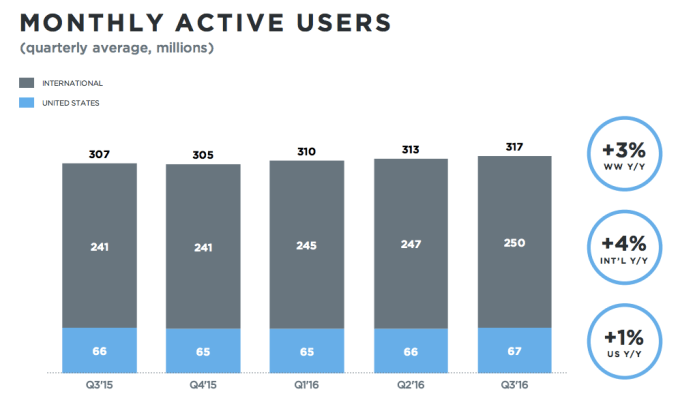

Twitter reported earnings of 13 cents per share and revenue of $616 million, and the service grew to 317 million users. Analysts were looking for earnings of 9 cents per share on around $606 million in revenue, as well as 315 million monthly active users. Last quarter, the company had 313 million monthly active users.

After the rare beat — and a brief rush of optimism — Twitter’s shares rose as much as 5% in pre-market trading. Ironically, by Twitter standards, this isn’t that much of a swing, but it surely must be a breath of fresh air for the company’s executive team and employees which have seen the company’s stock continue to stumble for the past year. Given that there’s little guidance for the fourth quarter, however, shares have come down and are only up around 3.5% now.

As Twitter looks forward, the company isn’t even going to be reporting revenue guidance — a tradition for many technology companies as it looks to set expectations for Wall Street in the coming months. That seems largely because the company is going to be restructuring its sales teams as it “will move from three sales channels to two.” It seems that Twitter’s restructuring this time around is going to be a big rejiggering of the company’s core business driver, so we’ll have to see where things land next quarter.

Earlier this week it was reported that the company would lay off as much as 8% of its workforce — or 300 people — according to Bloomberg. We reported that, in these layoffs, the sales team in particular was being targeted. While for a long time business head Adam Bain was seen to have built a strong business, in recent quarters Twitter’s ability to grow its sales have become a question mark, especially as Facebook continues to add new users at a healthy clip and emerging platforms like Snapchat are growing like crazy and enticing advertisers.

Once again, it looks like the company’s sales is still not growing as fast as it needs to, especially as a company like Snapchat is looking to generate as much as $1 billion in revenue as it looks to IPO at a valuation as high as $35 billion next year. Advertising revenue grew only grew 6% year-over-year, while its small data and licensing revenue stream continues to grow at a semi-healthy clip.

Twitter did better than Wall Street expected, but it still needs to figure out how to re-ignite that growth engine.

Under CEO Jack Dorsey, who took over about a year ago, the company has said it’s going to try to make the service as straightforward — and less confusing — as possible. But in his first year, not a lot has been done outside of taking away character count contributions for some media and most recently for @ mentions. Twitter’s largest problem, its trolls, haven’t also been addressed at a product level. That final problem even scared away suitors like Disney and Salesforce from buying the company.

“To capture this large opportunity, and drive daily active usage across the millions of people at the top of our funnel each day, we’re refining our core service in four key areas: onboarding, the home timeline, notifications and Tweeting,” Twitter said in its earnings statement. “We’re rapidly iterating across these four areas and encouraged by the direct benefit we’ve seen from recent product improvements that are driving results in Q3, following the inflection in Q2.”

Even a cursory look at Dorsey’s tenure doesn’t show much for the company’s potential. Its stock has fared very poorly since he took over a year ago, user growth has slowed to an absolute crawl, and revenue growth appears to be tapering off.

Twitter continues to look at new product options, including live video like its Thursday-night NFL broadcasts. With an Apple TV app, it would seem like live-streaming events like this might actually be the company’s sweet spot, especially heading into the election. Twitter said its most-recent Thursday-night NFL games reached more than 3 million viewers, up from its first game, which had 2.35 million viewers. The second and third presidential debates had 3.3 million unique viewers, up 30% from the first debate, the company said.

One of Twitter’s additional largest problems is its stock-based compensation costs, which sits in the hundreds of millions, as it attempts to hold onto as much talent as possible. Totally unexpected: the company said stock-based compensation is going to be in the range of $150 to $160 in the fourth quarter this year.

Twitter’s paltry user growth continued today as it grew only a few percentage points, once again showing that the company still needs to figure out a way to capture new users. A lot of that is going to have to come from making the service less confusing and more palatable for on-boarding, but it still just isn’t quite there yet.

“While our efforts are beginning to drive growth in audience and engagement, we believe there is still significant opportunity ahead,” Dorsey said. “To get a better sense of the size of this opportunity: consider that each day there are millions of people that come to Twitter to sign up for a new account or reactivate an existing account that has not been active in the last 30 days.”

As its stock continues to tumble, so too do its hopes to attract as much talent as it can. For a company that rarely releases product updates — and often finds backlash when it does — Twitter needs to make sure it has the right people in place if it’s going to end up creating updates that its users are going to find valuable and fire the business back up again.

Featured Image: Drew Angerer/Getty Images