Very few people can move financial markets with their tweets, but like it or not, President-elect Donald Trump is one of them. And while you can’t do anything to prevent the madness, you can keep up with it using a new tool from Trigger Finance.

Originally a class project at Cornell Tech, Trigger makes it easy for users to set up real-time alerts when news drops about their stocks. Typically this includes notifications about upcoming earnings report announcements and news of price changes, but the startup is adding a “Trump Trigger” to ensure you’re looped in when Trump talks about your investments on his favorite social network.

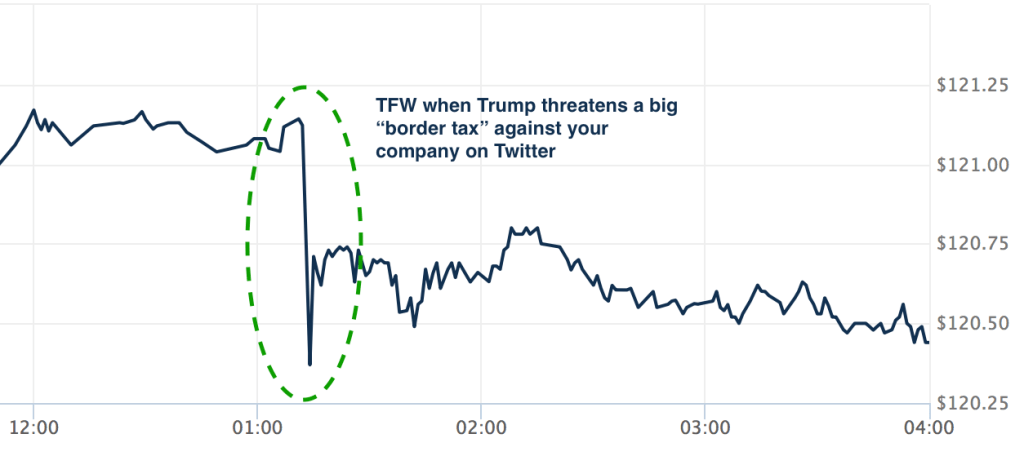

If you’re looking for an example of Trump’s ability to influence public markets with 140 characters, look no further than yesterday’s Toyota hullabaloo. Trump threatened a nondescript tax on the company if it moved some of its production to Mexico.

In response, the stock dipped roughly $0.77 instantaneously on the NYSE. Not a fantastically large amount — in fact, a very small overall percentage change, but in high volumes, it matters. And more importantly, it makes a point about the cause and effect relationship between President-elect Trump and public markets.

Cause

Effect

Data pulled from WSJ Advanced Charting — note: time difference is a result of PST vs EST

“These triggers can help you capture moves or manage your holdings based on the market’s reaction to the future President’s remarks,” the company said in a Medium post about the new feature.

Trigger is neither the first nor the last tool to push notifications about events impacting financial markets, but they deserve credit for jumping on top of such a timely concern.

Realistically, having a human in the loop means you won’t be forging the next Virtu Financial as a high-frequency trader, but the notifications are still helpful. As a journalist, it’s quite useful to assist in keeping tabs on the evolving relationship between publicly traded tech companies and our soon-to-be President.

Trigger Finance raised a $460 thousand angel round this time last year and is being run by Rachel Mayer, a former trader at J.P. Morgan.