Nigerian digital payments startup Paga is gearing up for international expansion with a $10 million round led by the Global Innovation Fund.

The company is exploring the release of its payments product in Ethiopia, Mexico, and the Philippines—CEO Tayo Oviosu told TechCrunch.

Paga looks to go head to head with regional and global payment players, such as PayPal, Alipay, and Safaricom according to Oviosu.

“We are not only in a position to compete with them, we’re going beyond them,” he said of Kenya’s MPesa mobile money product. “Our goal is to build a global payment ecosystem across many emerging markets.”

Launched in 2012, Paga has created a multi-channel network and platform to transfer money, pay bills, and buy things digitally 9 million customers in Nigeria—including 6000 businesses.

Since inception, the startup has processed 57 million transactions worth $3.6 billion, according to Oviosu. He joined Cellulant CEO Ken Njoroge and Helios Investment Partners’ Fope Adelowo at Disrupt San Francisco to discuss fintech and Africa’s tech ecosystem.

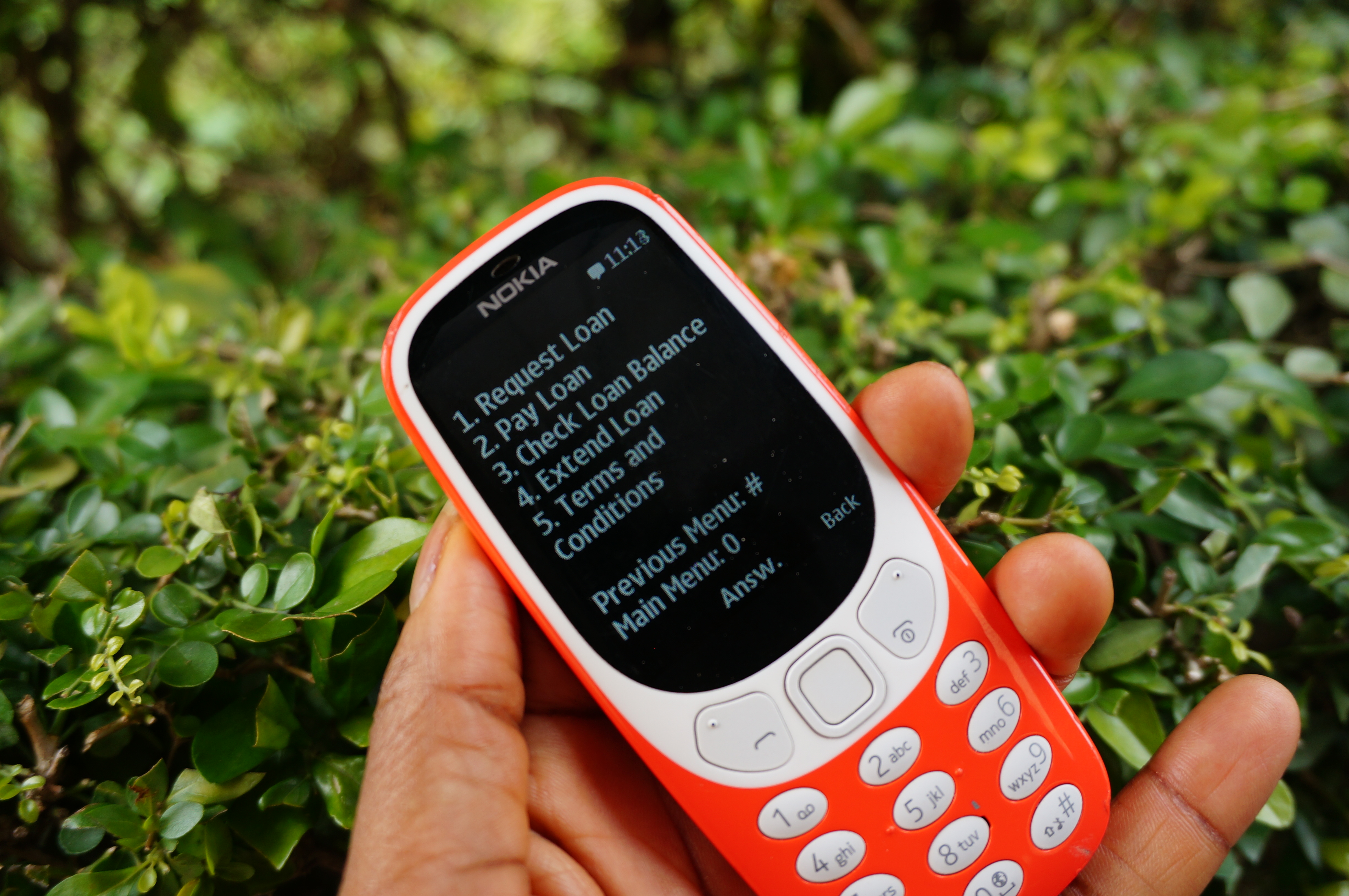

South African fintech startup Jumo raised a $52 million round (led by Goldman Sachs) to bring its fintech services to Asia. The company—that offers loans to the unbanked in Africa—has opened an office in Singapore to lead the way.

The new round takes Jumo to $90 million raised from investors and also saw participation from existing backers that include Proparco — which is attached to the French Development Agency — Finnfund, Vostok Emerging Finance, Gemcorp Capital, and LeapFrog Investments.

Launched in 2014, Jumo specializes in social impact financial products. That means loans and saving options for those who sit outside of the existing banking system, and particularly small businesses.

To date, it claims to have helped nine million consumers across its six markets in Africa and originated over $700 million in loans. The company, which has some 350 staff across 10 offices in Africa, Europe and Asia, was part of Google’s Launchpad accelerator last year. Jumo is led by CEO Andrew Watkins-Ball, who has close to two decades in finance and investing.

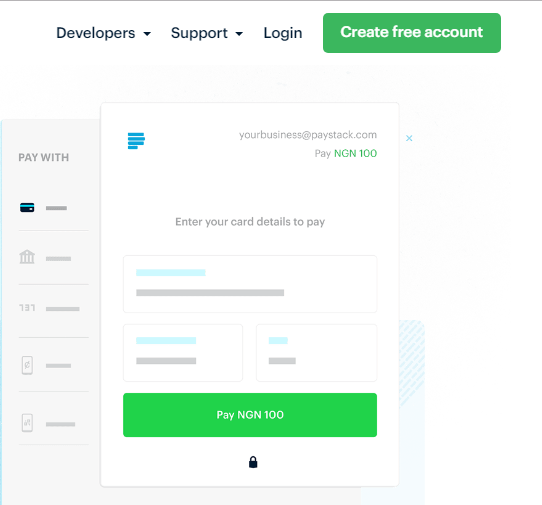

Lagos based Paystack raised an $8 million Series A round led by Stripe.

In Nigeria the company’s payment API integrates with tens of thousands of businesses, and in two years it has grown to process 15 percent of all online payments.

In 2016, Paystack became the first startup from Nigeria to enter Y Combinator, and the incubator is doing some follow-on investing in this round.

Other strategic investors in this Series A include Visa and the Chinese online giant Tencent, parent of WeChat and a plethora of other services. Tencent also invested in Paystack’s previous round: the startup has raised $10 million to date.

Paystack integrates a wide range of payment options (wire transfers, cards, and mobile) that Nigerians (and soon, those in other countries in Africa) use both to accept and make payments. There’s more about the company’s platform and strategy in this TechCrunch feature.

South African startup Yoco raised $16 million in a new round of funding to expand its payment management and audit services for small and medium-sized businesses as it angles to become one of Africa’s billion-dollar businesses.

South African startup Yoco raised $16 million in a new round of funding to expand its payment management and audit services for small and medium-sized businesses as it angles to become one of Africa’s billion-dollar businesses.

To get there the company that “builds tools and services to help SMEs get paid and manage their business” plans to tap $20 billion in commercial activity that the company’s co-founder and chief executive, Katlego Maphai estimates is waiting to move from cash payments to digital offerings.

Yoco offers a point of sale card reader that links to its proprietary payment and performance software at an entry cost of just over $100.

With this kit, cash-based businesses can start accepting cards and tracking metrics such as top-selling products, peak sales periods, and inventory flows.

Yoco has positioned itself as a missing link to “solving an access problem” for SMEs. Though South Africa has POS and business enterprise providers — and relatively high card (75 percent) and mobile penetration (68 percent) — the company estimates only 7 percent of South African businesses accept cards.

Yoco says it is already processing $280 million in annualized payment volume for just under 30,000 businesses.

The startup generates revenue through margins on hardware and software sales and fees of 2.95 percent per transaction on its POS devices.

Yoco will use the $16 million round on product and platform development, growing its distribution channels, and acquiring new talent.

Emerging markets credit startup Mines.io closed a $13 million Series A round led by The Rise Fund, and looks to expand in South America and Asia.

Mines provides business to consumer (B2C) “credit-as-a-service” products to large firms.

“We’re a technology company that facilitates local institutions — banks, mobile operators, retailers — to offer credit to their customers,” Mines CEO and co-founder Ekechi Nwokah told TechCrunch.

Most of Mines’ partnerships entail white-label lending products offered on mobile phones, including non-smart USSD devices.

With offices in San Mateo and Lagos, Mines uses big-data (extracted primarily from mobile users) and proprietary risk algorithms “to enable lending decisions,” Nwokah explained.

Mines started operations in Nigeria and counts payment processor Interswitch and mobile operator Airtel as current partners. In addition to talent acquisition, the startup plans to use the Series A to expand its credit-as-a-service products into new markets in South America and Southeast Asia “in the next few months,” according to its CEO.

Nwokah wouldn’t name specific countries for the startup’s pending South America and Southeast Asia expansion, but believes “this technology is scalable across geographies.”

As part of the Series A, Yemi Lalude from TPG Growth (founder of The Rise Fund) will join Mines’ board of directors.

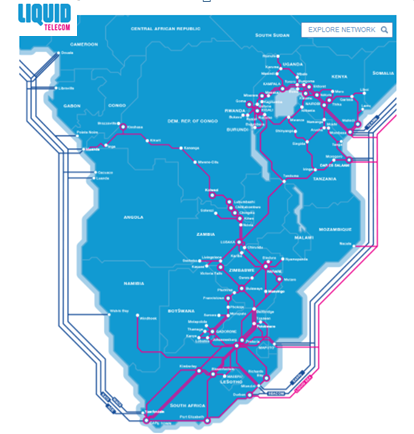

Digital infrastructure company Liquid Telecom is betting big on African startups by rolling out multiple sponsorships and free internet across key access points to the continent’s tech entrepreneurs.

The Econet Wireless subsidiary is also partnering with local and global players like Afrilabs and Microsoft to create a cross-border commercial network for the continent’s startup community.

“We believe startups will be key employers in Africa’s future economy. They’re also our future customers,” Liquid Telecom’s Head of Innovation Partnerships Oswald Jumira told TechCrunch.

With 13 offices on the continent, Liquid Telecom’s core business is building the infrastructure for all things digital in Africa.

The company provides voice, high-speed internet, and IP services at the carrier, enterprise, and retail level across Eastern, Central, and Southern Africa. It operates data centers in Nairobi and Johannesburg with 6,800 square meters of rack space.

Liquid Telecom has built a 50,000 kilometer fiber network, from Cape Town to Nairobi and this year switched on the Cape to Cairo initiative—a land-based fiber link from South Africa to Egypt.

Though startups don’t provide an immediate revenue windfall, the company is betting they will as future enterprise clients.

“Step one…in supporting startups has been….supporting co-working spaces and events with sponsorships and free internet,” Liquid Telecom CTO Ben Roberts told TechCrunch. “Step two is helping startups to adopt…business services.”

Liquid Telecom provides free internet to 30 hubs in seven countries and is active sponsoring startup related events.

On the infrastructure side, it’s developing commercial services for startups to plug into.

“At the early stage and middle stage, we’re offering startups connectivity, skills development, and access to capital through the hubs,” said Liquid Telecom’s Oswald Jumira.

“When they reach the more mature level, we’re focused on how we can scale them up…and be a go to market partner for them. To do that they’ll need to leverage…cloud services.”

Microsoft and Liquid Telecom announced a partnership in 2017 to offer cloud services such as Microsoft’s Azure, Dynamics 365, and Office 365 to select startups through free credits—and connected to comp packages of Liquid Telecom product offerings.

On the venture side, Liquid Telecom doesn’t have a fund but that could be in the cards.

“We haven’t yet started investing in startups, but I’d like to see that we do,” said chief technology officer Ben Roberts. “That can be the next move onwards… from having successful business partnerships.”

And finally, tickets are now available here for Startup Battlefield Africa in Lagos this December. The first two speakers were also announced, TLcom Capital senior partner and former minister of communication technology for Nigeria Omobola Johnson and Singularity Investment’s Lexi Novitske will discuss keys to investing across Africa’s startup landscape.

More Africa Related Stories @TechCrunch

African Tech Around the Net