With Deliveroo and Uber currently battling it out on London’s streets to deliver food from local restaurants, a third player with deep pockets may be about to enter the fight. According to multiple sources within the tech and food industry, Amazon is eyeing up a launch for its Amazon Restaurants service in the U.K. capital city.

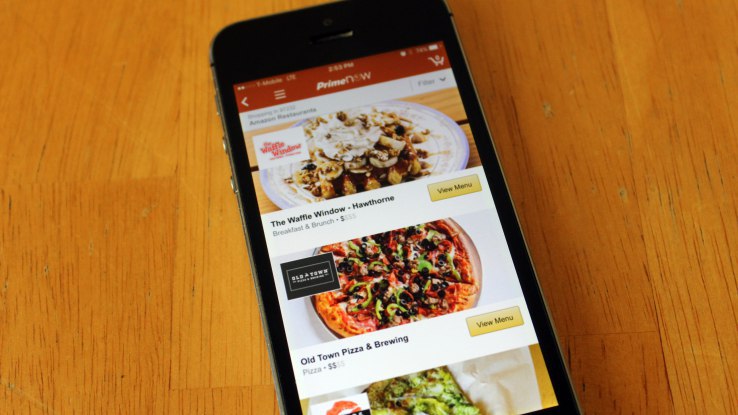

Already rolled out in the U.S. — we count at least 8 cities, including San Francisco, San Diego, Chicago, Seattle, Los Angeles, Baltimore, Austin, and Portland -– Amazon Restaurants lets you order food from the menus of partner restaurants via the Prime Now app for one-hour delivery. Now it looks like the groundwork is being laid to bring the service to Londoners.

My understanding is that Amazon has been approaching a number of London’s leading restaurants, many of whom are already listed on Deliveroo and more recently Uber’s UberEats service, to try to sign them up to a pending Amazon Restaurants launch. How successful that’s been is unclear. Further details are also thin on the ground, with discussions between Amazon and restaurants typically subject to NDA.

Asked to confirm that the online retailer is bringing its restaurant delivery service to the U.K., a spokesperson for Amazon said that the company doesn’t comment on “rumour and speculation regarding future plans”.

I’ve also been told by one source that Amazon recently listed job vacancies related to a possible Amazon Restaurants launch in the U.K., but I haven’t been able to verify this directly. That said, a LinkedIn profile lists a U.K. Head of Restaurants, from August 2014, who claims to have previously been part of Amazon’s Local team. Again, Amazon declined to comment.

What’s also interesting about a possible Amazon Restaurants launch in London is that neither it nor Deliveroo and UberEats appear to be trying to compete on price, in terms of the commission fee they charge restaurants per order. One restaurant source cites Amazon asking for 26 per cent, which wouldn’t be out of the ordinary, although lower rates are sometimes offered by competitors on the insistence of exclusivity i.e. if a restaurant agrees to only be listed by the one service.

Meanwhile, restaurant owners I’ve spoken to tell me they absolutely hate paying commission and feared that Deliveroo might become too powerful. That now looks premature but with all major restaurant delivery companies holding roughly to the same rate, an unofficial ‘industry standard’ is fast being established and reluctantly accepted by the supply-side of the market. Unless of course a price war eventually breaks out.

For now, all of the main players in London, which along with Deliveroo, Uber and possibly Amazon, includes Rocket Internet-backed Take Eat Easy, are competing on the basis of delivery times and customer service, how many new customers they can send restaurants, and, crucially, inventory i.e. actually signing up the restaurants and brands that consumers have an appetite for. It’s the latter part of the equation that could delay any potential Amazon Restaurants launch.