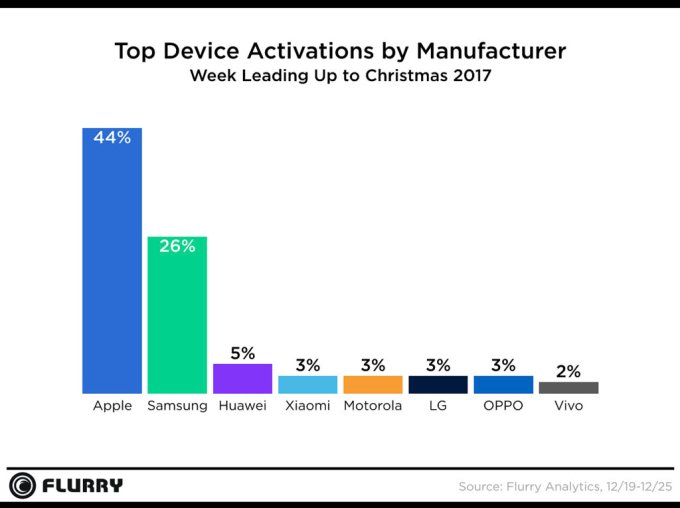

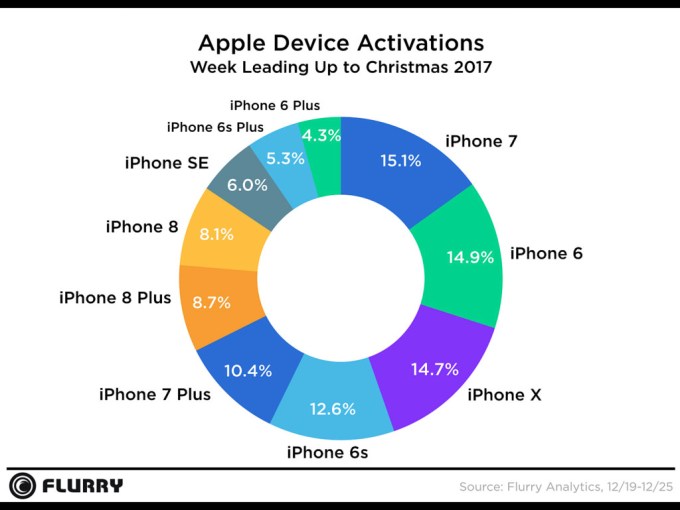

Apple devices accounted for 44 percent of smartphone and tablet activations over the holidays, with nearly a third of those coming from new devices including the iPhone 8, 8 Plus and X, according to new data from Flurry Analytics out this morning. However, the iPhone 7 and iPhone 6 actually took the top two spots in terms of Apple activations, at 15.1 percent and 14.9 percent, respectively.

Flurry’s* new report analyzed the holiday period by examining the activations throughout the week leading up to Christmas and the end of Chanukah.

It also found that Samsung’s activation rate had climbed 5 percent from last year, likely because of the launch of the Galaxy S8. But the manufacturer only made up 26 percent of all 2017 holiday activations, compared with Apple’s 44 percent – the same percentage Apple achieved last year, in fact.

Google, meanwhile, was missing from the list of top devices over the holiday season, despite the arrival of the Pixel 2. This, at first, is seemingly in contradiction to Localytics’ new report on holiday activations, also out today, which claims that Pixel 2 and Pixel 2 XL devices saw the largest lift in activations – even outpacing the iPhone X.

However, Localytics’ data is from the U.S. only, and looked at a different time frame – Christmas Weekend in the U.S., including Christmas Day. Meanwhile, Flurry’s report examines activations worldwide. This paints two different pictures of the market.

That global viewpoint also explains why older iPhone models came out on top in Flurry’s analysis.

The firm points out the high number of iPhone 6 and 7 activations are largely due to the affordability of the older models and their availability in markets outside the U.S. But it’s still fairly remarkable to see a device like the iPhone 6, which Apple relaunched to international resellers in spring 2017, seeing so many new activations. That points to a sizable market that’s choosing an iPhone based on cost, primarily.

Beyond Apple and Samsung, other top device makers seeing activations in the week leading up to Christmas included Huawei, Xiaomi, Motorola, LG, OPPO, and Vivo. Like the iPhone 6, they too, represent the “affordable” smartphone market, but from the Android side.

This is also the first year that Vivo made this chart – a change attributed to its growth in China and India.

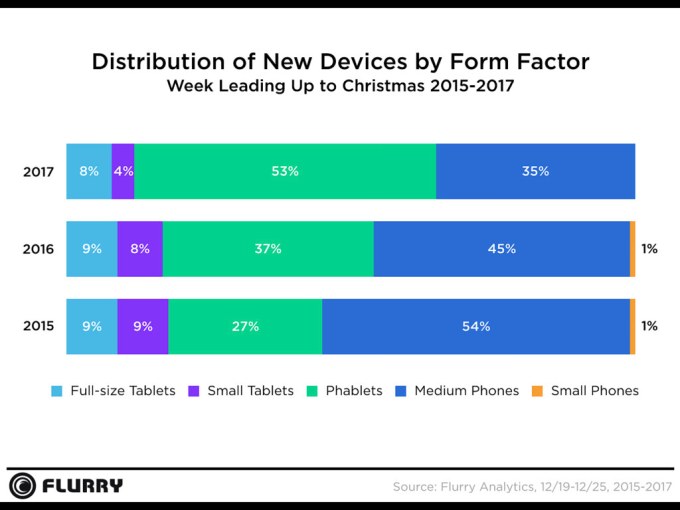

Flurry’s report also delved into form factor preferences, finding that so-called “phablets” (5 in. – 6.9 in.) have overtaken medium phones (3.5 in. – 4.9 in.) in 2017 market share with 53 percent of all holiday activations.

Along with the new activations, app install rates got their usual holiday bump as well. Flurry once again saw two times as many app installs on Christmas Day than on an average day in December. The top types of apps being installed included Messaging & Social, Games, Music, Media & Entertainment, and Kids & Family apps.

* (Disclosure: Both Flurry and TechCrunch are a part of Oath.)