Best Buy’s fiscal third quarter results were largely in line with expectations, but the timing of Apple’s iPhone X launch provided a headwind to revenue.

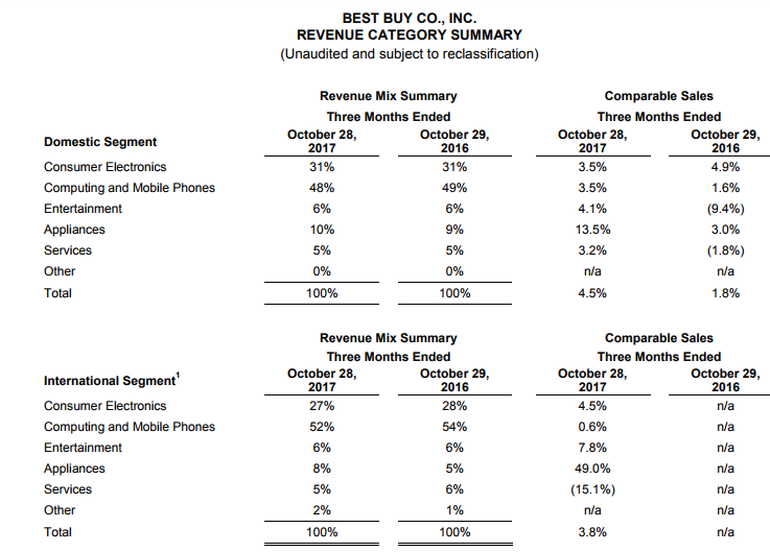

The retailer, which has shifted to an omnichannel model well as the industry has struggled, reported fiscal third quarter earnings of 78 cents a share on revenue of $9.32 billion, up from $8.94 billion a year ago. Same store sales were up 4.4 percent in the third quarter.

Best Buy’s earnings were in line with Wall Street estimates, but sales fell short of the $9.36 billion expected. The company said that revenue in the mobile phone category was down by more than $100 million because “a major phone launch did not happen until November.” We know unnamed phone is iPhone X.

Another wrinkle for Best Buy was that hurricanes and natural disasters shaved 3 cents a share from earnings.

Nevertheless, Best Buy’s quarter was solid. Online sales were up 22.3 percent to $1.1 billion.

As for the outlook, Best Buy said it expects fiscal 2018 revenue growth of 4 percent to 4.8 percent with non-GAAP operating income growth of 7 percent to 9.5 percent. That guidance is stronger than what Best Buy previously projected.

For the fourth quarter, Best Buy projected revenue of $14.2 billion to $14.5 billion with non-GAAP earnings of $1.89 a share to $1.99 a share. For fiscal 2018, Best Buy sees revenue of $41 billion to $41.3 billion.

CEO Hubert Joly said the company was “excited about our plans for holiday, including a curated assortment of great new technology products, free shipping with no minimums, and a range of new capabilities such as our new In-Home Advisor program, an updated gift center, and same-day delivery in 40 cities.”