The African no-fee, cross-border payment startup Chipper Cash has raised a $2.4 million seed round led by Deciens Capital.

The payments company also persuaded 500 Startups and Liquid 2 Ventures—co-founded by Joe Montana—to join the round.

Chipper Cash’s Ugandan chief executive, Ham Serunjogi, pitched the U.S. football legend directly. “He was quite excited about what we’re doing and his belief that the next wave of [tech] growth will come from…Africa,” Serunjogi told TechCrunch.

Chipper Cash went live in October 2018, joining a growing field of fintech startups aiming to scale digital finance applications across Africa’s billion plus population.

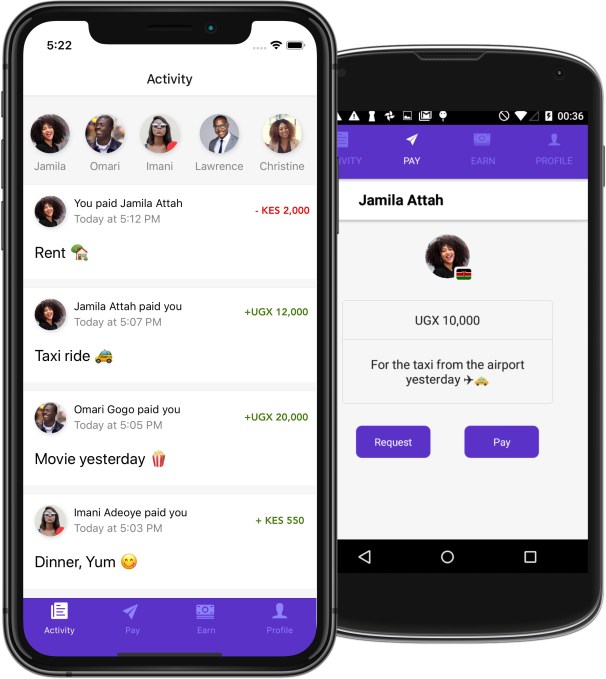

The venture Serunjogi co-founded with Ghanaian Maijid Moujaled offers no-fee, P2P, cross-border mobile-money payments in Africa.

Based in San Francisco based startup—with offices in Ghana and Nairobi—Chipper Cash has processed 250,000 transactions for over 70,000 active users, according to Serunjogi.

In conjunction with the seed round, Chipper Cash is launching Chipper Checkout: a merchant focused, C2B, mobile payments product.

In conjunction with the seed round, Chipper Cash is launching Chipper Checkout: a merchant focused, C2B, mobile payments product.

This side of the startup’s offerings isn’t free, and Chipper Cash will use revenues from Chipper Checkout—in addition to income generated from payment volume float—to support its no-fee mobile money business.

Sheel Mohnot, who led 500 Startups’ investment in Chipper Cash, likened company’s model to PayPal.

“When PayPal started it was just a consumer to consumer free app. It still is free for consumer to consumer, they but they monetized the merchant side. That model is tried and tested. It just doesn’t exist in Africa, so Chipper has the opportunity to do that,” he told TechCrunch.

In addition to Kenya’s M-Pesa—the global success story for digital payments—there are a number of mobile money products in Africa, from MTN’s Mobile Money in Ghana to Tigo Pesa in Tanzania.

The limiting factor, though, according to Chipper Cash’s CEO is interoperability, or that mobile-money transfers across product platforms, currencies, and borders generally don’t work.

“Our tech settles cross-border currency transactions in real-time, and that’s part of the value proposition of the platform,” he said.

The startup will expand beyond its current four country operations in Ghana, Kenya, Rwanda, Tanzania, and Uganda within the next 12 months. Chipper Cash also plans to tap the global remittance market for Sub-Saharan Africa, a large pool of roughly $38 billion, in the near future.

Remittances won’t be the firms’ top focus, however. Serunjogi believes there’s more volume to be found within Africa. “Demographics, migration, and regional economic-integration within the continent means there’ll be an infinitely growing amount of cross-border commercial activity within Africa,” he said. “When it comes to payments, the pie is growing and…the percentage of that pie that is digital payments will also grow.”

The journey for Chipper Cash’s founders from Africa to founding a startup and pitching to Joe Montana passes through Iowa. Serunjogi and Moujaled met when doing their undergraduate degrees at Grinnell College. Stints at Silicon Valley companies followed: Facebook for Serunjogi and Flickr, Yahoo!, and Imgur for Moujaled.

The journey for Chipper Cash’s founders from Africa to founding a startup and pitching to Joe Montana passes through Iowa. Serunjogi and Moujaled met when doing their undergraduate degrees at Grinnell College. Stints at Silicon Valley companies followed: Facebook for Serunjogi and Flickr, Yahoo!, and Imgur for Moujaled.

Chipper Cash was accepted in 500 Startups’ Batch 24 in 2018 and their demo day for the accelerator program gained the attention of Liquid 2 Ventures.

The VC fund’s Rocio Wu invited them to pitch to Joe Montana and the team in March 2019.

“Africa is extremely fragmented with different languages, cultures and currencies, Chipper Cash is uniquely positioned to tackle cross-border mobile payments with interoperability,” Wu told TechCrunch on the investment.

Wu will join Chipper Cash as a board observer. The startup is the second Africa investment for the fund. Liquid 2 Ventures is also an investor in logistics startup Lori Systems, the 2017 Startup Battlefield Africa winner.

![]()

Startups building financial technologies for Africa’s 1.2 billion population are gaining greater attention of investors. As a sector, fintech (or financial inclusion) attracted 50 percent of the estimated $1.1 billion funding to African startups in 2018, according to Partech.

By a number of estimates, the continent’s 1.2 billion people represent the largest share of the world’s unbanked and underbanked population. An improving smartphone and mobile-connectivity profile for Africa (see GSMA) turns this scenario into an opportunity for mobile based financial products.

As more startups enter African fintech, Chipper Cash believes it can compete on its cross-currency and no-fee offerings and the growing size of the market. “It’s so large that it is unlikely to be a zero-sum game in terms of who wins. There will be multiple successful players,” said Serunjogi

Chipper Cash also joins a list of African founded, Africa focused fintech firms that have chosen to set up HQs in San Francisco with offices and operations on the continent. Payments gateway company Flutterwave and lending venture Mines.io (both with Nigerian founders) maintain SF headquarters with operations in Lagos. Serunjogi touts the benefits of this two continent organizational structure for access to both VC and developer markets in the U.S. and Africa.

As for Chipper Cash’s continuing relationship with investor Joe Montana, “Having access to a someone with the leadership qualities of Joe to provide advice and guidance…that’s something that’s priceless,” said Serunjogi.