The analysts at Gartner have published their annual global device forecast, and while 2020 looks like it may be partly sunny, get ready for more showers and poor weather ahead. The analysts predict that a bump from new 5G technology will lead to total shipments of 2.16 billion units — devices that include PCs, mobile handsets, watches, and all sizes of computing devices in between — working out to a rise of 0.9% compared to 2019.

That’s a modest reversal after what was a rough year for hardware makers who battled with multiple headwinds that included — for mobile handsets — a general slowdown in renewal cycles and high saturation of device ownership in key markets; and — in PCs — the wider trend of people simply buying fewer of these bigger machines as their smartphones get smarter (and bigger).

As a point of comparison, last year Gartner revised its 2019 numbers at least three times, starting from “flat shipments” and ending at nearly four percent decline. In the end, 2019 saw shipments of 2.15 billion units — the lowest number since 2010. All of it is a bigger story of decline. In 2005, there were between 2.4 billion and 2.5 billion devices shipped globally.

“2020 will witness a slight market recovery,” writes Ranjit Atwal, research senior director at Gartner . “Increased availability of 5G handsets will boost mobile phone replacements, which will lead global device shipments to return to growth in 2020.”

(Shipments, we should note, do not directly equal sales, but they are used as a marker of how many devices are ordered in the channel for future sales. Shipments precede sales figures: overestimating results in oversupply and overall slowdown.)

The idea that 5G will drive more device sales, however, is still up for debate. Some have argued that while carriers are going hell for leather in their promotion of 5G, the idea of special 5G apps and services — versus using it to connect machines in an IoT play — that will spur adoption of those devices is not as apparent, and that’s leading to it being more of an abstract concept, and not one that is leading the charge when it comes to apps and services, especially for the mass consumer market and for (human) business users.

Still, it may be that hardware might march on ahead regardless. Gartner predicts that 5G devices will account for 12% of all mobile phone shipments in 2020 as handset makers make their devices “5G ready,” with the proportion increasing to 43% by 2022. “From 2020, Gartner expects an increase in 5G phone adoption as prices decrease, 5G service coverage increases and users have better experiences with 5G phones,” writes Atwal. “The market will experience a further increase in 2023, when 5G handsets will account for over 50% of the mobile phones shipped.” That may in part be simply because handset makers are making their devices “5G ready”

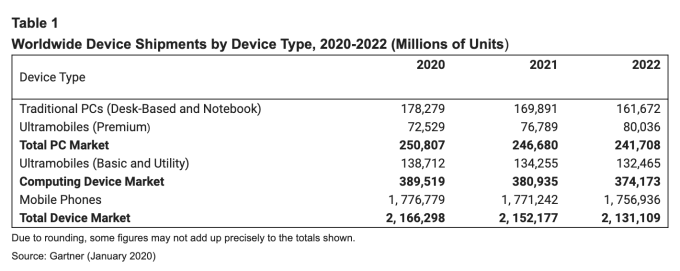

Drilling down into the numbers, Gartner believes that worldwide, phones will see a bump of 1.7% this year, up to 1.78 billion before declining again in 2021 to 1.77 billion and then further in 2022 to 1.76 billion. Asia and in particular China and emerging markets will lead the charge.

Another analyst firm, Counterpoint, has been tracking marketshare for individual handset makers and notes that Samsung remains the world’s biggest handset maker going into Q4 2019 (final numbers on that quarter should be out in the coming weeks), with 21% of all shipments and slight increases over the year, but with the BBK group (which owns OPPO, Vivo, Realme, and OnePlus) likely to pass it, Huawei and Apple to become the world’s largest, as it’s growing much faster. Numbers overall were dragged down by declines for Apple, the world’s number-three handset maker, which saw a slump last year in its handset sales.

Although the market was generally lower across all devices, PC shipments actually saw some growth in 2019. That is set to turn down again this year, to 251 million units, and declining further to 247 million in 2021 and 242 million in 2022.

Part of that is due to slower migration trends — Windows 10 adoption was the primary driver for people switching up and buying new devices last year, but now that’s more or less finished. That will see slower purchasing among enterprise end users, although later adopters in the SME segment will finally make the change when support for Windows it 7 finally ends this month (it’s been on the cards for years at this point). In any case, the upgrade cycle is changing because of how Windows is evolving.

“The PC market’s future is unpredictable because there will not be a Windows 11. Instead, Windows 10 will be upgraded systematically through regular updates,” writes Atwal “As a result, peaks in PC hardware upgrade cycles driven by an entire Windows OS upgrade will end.”

Two trends that might impact shipments — or at least highlight other currents in the hardware market — should also be noted. The first is the role that Chromebooks might play in the PC market. These were one of the faster-growing categories last year, and this year we will see even more models rolled out, with what hardware makers hope will be even more of a boost in functionality to drive adoption. (Google and Intel’s collaboration is one example of how that will work: the two are working on a set of standards that will fit with chips made by Intel to produce what the companies believe are more efficient and compelling notebooks, with tablet-like touchscreens, better battery life, smaller and lighter form factors, and more.)

The second is whether or not smartwatches will make a significant dent into the overall device market. Q3 of last year saw growth of 42% to 14 million shipments globally. And while there have been a number of smartwatch hopefuls, but one of the biggest successes has been the Apple Watch, whose growth outstripped that of the wider watch market, at 51%. Indeed, looking at the results of the last several quarters, Apple’s product category that includes Watch sales (wearables, home and accessories) even appears to be on track to outstrip another hardware category, Macs. Whether that will continue, and potentially see others joining in, will be an interesting area to “watch.”