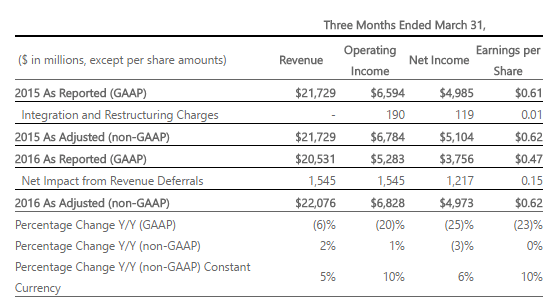

Microsoft today announced earnings for its third financial quarter of 2016. The company reported non-GAAP revenue of $22.1 billion for the last quarter and $0.62 of adjusted earnings per share (EPS) and $0.47 GAAP EPS.

Wall Street expected Microsoft to report an EPS of $0.64 on revenue of just under $22.1 billion. Microsoft’s own guidance for the quarter was for revenue to be somewhere between $21.1 billion and $22.3 billion.

Wall Street is obviously not happy with these numbers. Microsoft’s stock is currently down close to 5 percent in after-hours trading.

As Microsoft’s director of investor relations Zack Moxcey told me after the earnings release hit, the EPS miss is mostly due to the fact that these numbers include Microsoft’s catch-up adjustments for its income tax expenses. Without these, he noted, the EPS would have been $0.04 higher and would have beaten Wall Street expectations.

Previously, the company said it expected for this number to hit $20 billion in 2018. It didn’t reiterate this number in today’s press release, though Moxcey told me that the company is sticking with this number. “We feel this is a solid performance across the board,” he told me. “Certainly, the cloud continues to be a highlight for us.”

“Organizations using digital technology to transform and drive new growth increasingly choose Microsoft as a partner,” said Microsoft CEO Satya Nadella. “As these organizations turn to us, we’re seeing momentum across Microsoft’s cloud services and with Windows 10.”

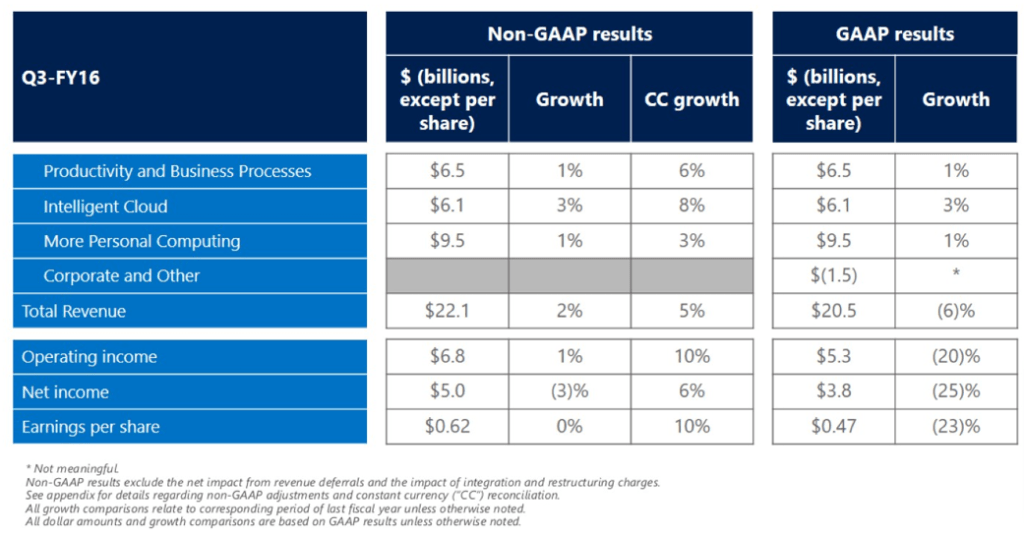

Microsoft started breaking out results for different business units with its Q1 2016 report and it continues this tradition with this quarter’s report.

Here is what the rest of these numbers look like.

- Productivity and Business Processes (PBP), including Office, consumer Office and Dynamics: $6.5 billion compared to $6.7 billion in revenue last quarter. Microsoft says it now has 22.2 million paying Office 365 consumer users, up 6 percent. Commercial Office 365 revenue was up 63 percent year-over-year.

- Intelligent Cloud (IC), which includes service revenue and Enterprise Services: $6.1 billion compared to $6.4 billion in the last quarter. Azure revenue here grew 120 percent.

- More Personal Computing (MPC), which contains Windows, Devices, Gaming and Search: $9.5 billion. Last quarter, the company reported $12.7 billion in revenue for this group.

Unsurprisingly, phone revenue declined 46 percent compared to last year. On the positive side, Surface revenue increased 61 percent year-over-year and Moxcey noted that this marked the second quarter in a row that Surface itself drove more than $1 billion revenue. At the same time, though, Windows OEM revenue was down 2 percent. Moxcey noted that this still outperformed the PC market, mostly because the first wave of Windows 10 devices was generally pricier and drove up Microsoft’s revenue per unit.

One other number everybody was looking for in today’s announcement was how Microsoft’s commercial cloud business is doing — especially as the PC market remains sluggish. In the last quarter, Microsoft said this segment was on a $9.4 billion annual run rate, up from $8.2 billion in the quarter before that. Now, the company says the annual run rate has hit $10 billion.

While Microsoft’s last quarter didn’t quite live up to Wall Street’s expectations, those cloud numbers and the increase in Office 365 subscriptions show that the company’s overall turn-around plan is working, though.