TPG’s new mobile plans

(Image: TPG)

Australian mobile mobile virtual network operators (MVNOs) TPG and Vaya have both announced new mobile plans ahead of Apple’s iPhone launch event this week, during which it will reportedly unveil three new smartphones: The iPhone 8, the iPhone 8 Plus, and the iPhone X.

Vaya, now owned by Amaysim — which itself announced a series of new SIM-only mobile plans in July — announced on Tuesday morning that it is upping its monthly data allowances across all four pricing tiers.

On a month-by-month basis, customers can pay AU$16 per month for 1.5GB of data; AU$24 will provide them with 3GB; AU$36 will provide 10GB; and AU$44 will provide 13GB of data per month.

Vaya’s six-month plans will see customers charged a total of AU$84 for 1.5GB of data per month; AU$132 for 3GB; AU$204 for 10GB; and AU$252 for 13GB.

“With market trends showing an increase in data usage across the board, Vaya is bringing bigger and better data inclusions to ensure it provides the best value for money for customers,” Vaya, which wholesales Optus’ 4G network, said.

Vaya is charging from 2 cents per minute for its international calling rates, but will provide 200 minutes of international calls to customers on its top two plans for AU$2 per month.

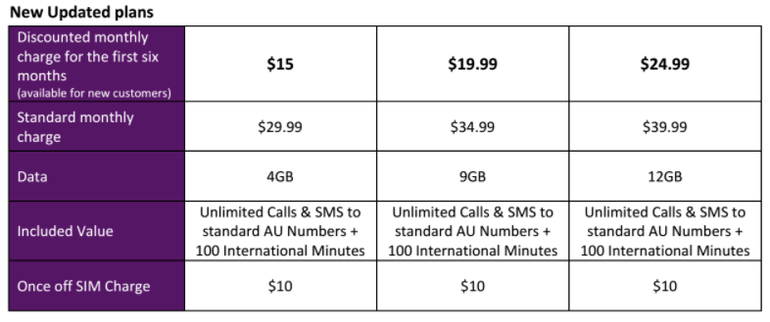

On Monday, TPG likewise refreshed its SIM-only mobile plans amid an effort to “address the sub-AU$20 price point”.

TPG mobile customers will pay AU$29.99 per month for 4GB of data and 100 international minutes; AU$34.99 per month for 9GB and 100 international minutes; and AU$39.99 per month for 12GB and 100 international calling minutes.

However, for the first six months, new customers signing up for TPG’s mobile service will pay just AU$15, AU$19.99, or AU$24.99 per month, respectively, for the three tiers.

“As Australia’s fourth mobile operator, we continue to work in the background building our own mobile network — but right now, we have some exciting deals for cost-conscious and data-hungry consumers through our MVNO setup. We are driving prices down as well as increasing data allowances.” TPG COO Craig Levy said.

“We cut out all the unnecessary costs, we don’t have retail outlets, and we post the SIM directly to our customers for online activation.”

According to market research company Kantar, the quarter ending June 30 saw TPG/iiNet hold 2.3 percent of the total Australian mobile market, while Amaysim and Vaya held 4.7 percent.

Amaysim/Vaya gained 1 percentage point in prepaid and lost 0.3 in post-paid, to hold 6.9 percent and 3.5 percent of the respective markets.

TPG/iiNet gained 0.1 percentage point in prepaid for a total of 7.7 percent of the market, and lost 0.8 points in post-paid for 2.8 percent market share, Kantar reported.

While TPG currently wholesales Vodafone’s 4G network, it is in the midst of raising AU$400 million to help fund its own AU$1.9 billion mobile network.

TPG had earlier this year announced that it would become the fourth mobile operator in Australia by using its purchase of 2x 10MHz of mobile broadband spectrum in the 700MHz band and combining this with its existing holdings in the 2.5GHz and 1800MHz bands.

“TPG will build a mobile network in Australia using current advanced technology for AU$1.9 billion, comprising AU$600 million for network rollout capital expenditure over a three-year period to achieve 80 percent population coverage; and AU$1,260 million for the 700MHz spectrum, which will be payable in three annual instalments,” TPG said in April.

“The network would provide broad coverage across densely populated areas of the country with approximately 2,000 to 2,500 sites. TPG estimates that its mobile network would be EBITDA break-even with 500,000 subscribers.”

TPG will provide a market update on its mobile network build next week.

TPG also spent SG$23.8 million on acquiring 2x 5MHz in the 2.5GHz band in the Singaporean mobile broadband market this year after procuring 2x 5MHz in the 900MHz spectrum band and 8x 5MHz in the 2.3GHz spectrum band for SG$105 million to become the fourth provider in the Singaporean mobile market alongside Singtel, StarHub, and M1.

As of June 30, Kantar said Telstra held 39.5 percent of Australia’s total mobile market, followed by Optus, at 24.2 percent; Vodafone Australia, at 14.4 percent; Virgin Mobile, at 4.4 percent; and Aldi Mobile, at 3 percent.

Telstra and Vodafone similarly recently updated their mobile plans ahead of the iPhone launch, with Telstra last week announcing the addition of media content, streaming inclusions, and extra data to its post-paid plans under a media partnership with Foxtel.

Under the new post-paid inclusions with Foxtel, paying AU$129 per month will give Telstra customers 30GB of data and two Foxtel Now starter packs; AU$149 will provide three starter packs and 50GB of data; and AU$199 will provide 100GB of data and three starter packs.

This followed Vodafone in August announcing a refresh of its Red post-paid mobile plans, making them more flexible so customers can buy smartphones outright under a 12-month SIM-only or month-to-month SIM-only plan, or sign up for a 12-, 24-, or 36-month contract with monthly instalments without being charged interest or being fined for paying off the device earlier.

Vodafone’s new Red plans include nine options under the monthly instalment repayment choice: AU$30 per month for 3GB of data; AU$40 for 6GB of data and 650 minutes of international calling; AU$50 for 14GB of data plus 1,200 minutes of international calling and 4,000 Qantas Frequent Flyer points; AU$50 for 16GB of data; AU$60 for 20GB of data plus 1,300 minutes of international calling and 5,000 Qantas points; AU$60 for 22GB of data; AU$80 for 30GB of data, plus 1,400 minutes of international calling and 7,500 Qantas points; AU$80 for 32GB of data; and AU$100 per month for 50GB of data.

In addition to the upfront cost of the handset, Vodafone’s new SIM-only month-to-month plans give customers the options of paying AU$30 per month for 1GB of data; AU$40 per month for 3GB; AU$50 for 6GB plus 1,100 minutes of international calls; AU$60 for 9GB plus 1,150 minutes of international calls; AU$80 for 15GB plus 1,200 minutes of international calls; or AU$100 for 25GB of data.

Vodafone’s SIM-only 12-month plans after upfront device payment cost AU$30 per month for 2GB of data; AU$40 for 12GB plus 650 minutes of international calling; AU$50 for 14GB, plus 1,000 minutes of international calling and 4,000 Qantas points; AU$50 for 16GB; AU$60 for 18GB plus 1,300 minutes of international calling and 5,000 Qantas points; AU$60 for 20GB; AU$80 for 30GB plus 1,000 minutes of international calling and 7,500 Qantas points; AU$80 for 32GB; or AU$100 for 50GB.