Xiaomi, which has led the Indian smartphone market for three consecutive years, has ceded ground to its long-rival Samsung in the world’s second largest market, according to a new report.

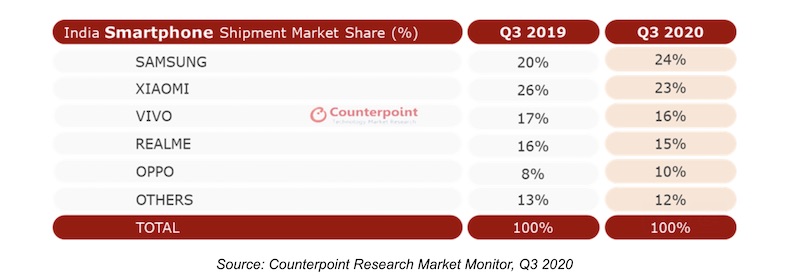

According to estimates from marketing research firm Counterpoint, Samsung commanded 24% of the Indian smartphone market in the quarter that ended in September this year, ahead of Xiaomi’s 23% share. (For context: During Q3 2019, Samsung assumed 20% of the smartphone market in India while Xiaomi captured 26%.)

Counterpoint’s finding is in contrast to what research firm Canalys reported last week. According to Canalys, Xiaomi held the top spot in India with 26.1% of the market share in Q3 2020, ahead of Samsung’s 20.4%.

But both the firms agree that India’s smartphone market saw a sharp rebound during the quarter. According to Counterpoint, more than 53 million smartphone units shipped in Q3 2020 at a 9% year-over-year growth. (Canalys pegged the figure to be about 50 million.)

The volume of units Samsung shipped in Q3 2020 was up 32% year-over-year, Counterpoint said. The company has benefited from its recent aggressive push in online sales and launch of several affordable smartphone handsets in recent months, Counterpoint analysts said.

Xiaomi, which entered India in 2014 and for several years sold exclusively through e-commerce platforms, is still the top online brand in India, Counterpoint said. But the company, which identifies India as its biggest market outside of China, is struggling to grapple with a growing anti-China sentiment in India among consumers as tension between the two neighboring nations has escalated in recent quarters.

This tension may lead to some more changes in the market in the coming months. Micromax, an Indian smartphone vendor that once ruled the market, said earlier this month that it was gearing up to launch a new smartphone sub-brand called “In.” Rahul Sharma, the head of Micromax, said the company will invest $67.9 million in the new smartphone brand.

In a video he posted on Twitter earlier this month, Sharma said Chinese smartphone makers killed the local handset makers but the time had come to fight back. “Our endeavour is to bring India on the global smartphone map again with ‘in’ mobiles,” he said in a statement.

It’s worth pointing out that long before Chinese smartphone makers, who command more than 70% of the local smartphone market in India, arrived to the country, they engaged closely with Chinese phone makers. Chinese firms manufactured the phones and sold it to Indian firms under a white-label agreement.

Indian firms then sold those phones to consumers in the country. Eventually, Chinese smartphone makers cut the middlemen and started to sell better smartphone models at much better prices to Indian directly, said Jayanth Kolla, a smartphone industry veteran and chief analyst at consultancy firm Convergence.

India also recently approved applications from 16 smartphone and other electronics companies for a $6.65 billion incentives program under New Delhi’s federal plan to boost domestic smartphone production over the next five years. Foxconn (and two other Apple contract partners), Samsung, Micromax and Lava (also an Indian brand) are among the companies that will be permitted to avail the incentives.

Missing from the list are Chinese smartphone makers such as Xiaomi, Oppo, Vivo, OnePlus and Realme.