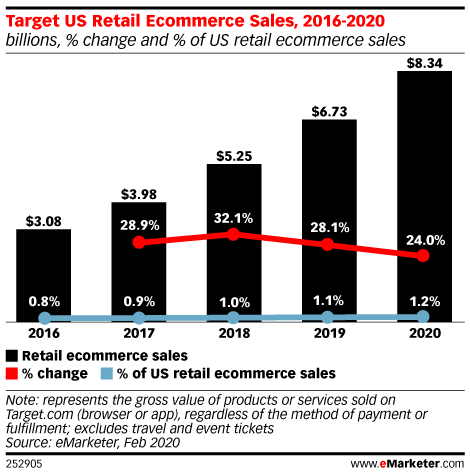

Target’s investments in store remodels, same-day delivery and drive-up services are paying off. The retailer, which used to rank No. 11 in U.S. e-commerce sales, is now forecast to jump three spots to break into the top 10 list as the No. 8 retailer, according to a new report from analyst firm eMarketer. This puts Target ahead of declining businesses QVC and Qurate Retail Group (HSN’s owner), as well as No. 9 Costco and No. 10 Macy’s, the new forecast says.

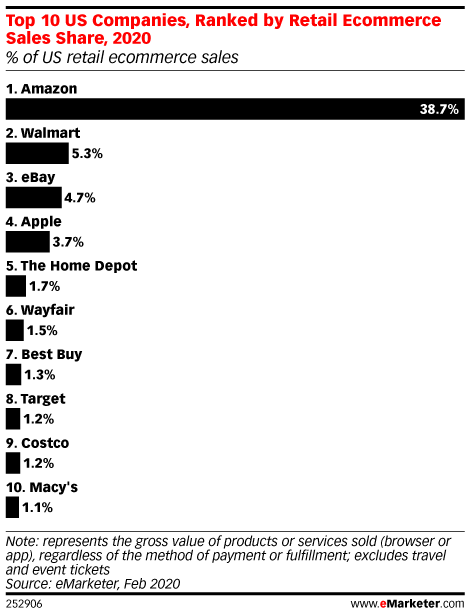

The firm estimates Target’s e-commerce business will grow 24% in 2020 to reach $8.34 billion, allowing it to crack the top 10 list. However, Target’s overall share of the U.S. e-commerce market remains small in the shadow of Amazon’s dominance. Amazon will claim a 38.7% share of the market this year, versus Target’s 1.2%. Even Amazon’s next nearest competitor Walmart is far behind, with just a 5.3% share.

The rest of the top 10 list includes eBay (5.3%), Apple (3.7%), Home Depot (1.7%), Wayfair (1.5%), Best Buy (1.3%), then Target (1.2%) followed by Costco (1.2%) and Macy’s (1.1%).

Target will just barely pass Costco, which is forecast to generate $8.33 billion in e-commerce sales in 2020. Its growth also comes at the expense of Macy’s, which is dropping from 1.2% in 2019 despite its growing online business. Qurate (HSN) is dropping from 1.2% in 2019 to just 1.0% this year, to find itself out of the top 10 list entirely for the first time.

It’s worth noting that Amazon last year took on video shopping networks HSN and QVC with a live-streamed video shopping service of its own. Amazon Live, as its service is called, streams live video shows from both Amazon talent and brands broadcasting their own streams. That may account for some of the declines these rival networks are seeing in 2020, though the increased numbers of cord-cutters and “cord-nevers” is also likely a contributor, as now fewer people are tuning in to shop via their TV.

However, eMarketer chalks up their decline, as well as Macy’s, to the softening apparel market. But that’s something impacting all retailers, not just these three — and not just online retail. In January, the U.S. Commerce Department said receipts at clothing stores dropped 3.1% in the month — the most since March 2009.

There are several factors at play here. Baby boomers aren’t shopping for clothes as often, casual workplaces mean people can get buy with less expensive apparel and personalized clothing delivery services like Stitch Fix are becoming more popular. In addition, climate change delivered the second-warmest January in nearly 30 years, reducing the need to shop for winter clothes.

Millennials also don’t invest as much into their wardrobes as prior generations, and have helped further popularize ideas like capsule closets, clothing rental services and reducing waste by shopping second-hand from places like The RealReal, ThredUp, Poshmark and elsewhere.

Target’s gains in 2020 aren’t only due to competitors’ struggles or apparel declines, however.

The company has invested heavily to reimagine its business for the age of online shopping. It has innovated on new fulfillment options like next-day (e.g. Target Restock) and same-day via Drive Up and Shipt, for example. Its store remodels took into account a need to better accommodate Target’s digital sales, by making more room for online order pickup.

“At a time when brick-and-mortar stores are struggling to keep up with the fast-changing retail landscape, Target seems to have hit the bullseye,” said eMarketer forecasting analyst Cindy Liu, in a statement. “Store renovations and expanding same-day fulfillment options, such as in-store pickup, drive-up, and delivery with Shipt, are paying off. Target has found a way to use its stores to fulfill online orders while keeping up with customer demands for convenience and speed,” she added.

Other retailers losing market share in 2020 include eBay and Apple, both which will see slight drops.

Amazon, meanwhile, will grow from 37.3% market share in 2019 to 38.7% in 2020, and will capture 4.6% of total retail sales, both online and offline.