A survey of UK Angel investors regarding their investment strategy during the COVID-19 pandemic has found that over 65% of Angels investors are continuing to invest in startups during Lockdown, but with predominantly new deals. Many are completing more deals and increasing their cheque size by as much as 18%. However, the pandemic has reduced their total capital to invest in 2020 by just over 61%, while just under 60% think the effects of COVID-19 will negatively affect their ability to invest for the rest of 2020. Over 250 Angels completed the full survey in the last two weeks, after TechCrunch exclusively published it.

These are the findings of new UK initiative Activate our Angels (AoA). The initiative comes just as the UK government’s “Future Fund” for startups, which has been criticized as being inadequate for the needs of Angel and Seed-stage startups, is poised to be launched some time this week.

AoA was started by Nick Thain the former CEO and co-founder of GiveMeSport, which was acquired last year and includes representatives from 7percent Ventures, Forward Partners, Portfolio Ventures, ICE, Foundrs, Punk Money, Humanity, Culture Gene, Barndance, Bindi Karia and Stakeholderz.

Activate our Angels started its campaign just under two weeks’ ago with the goal to give founders actionable data to help them make funding decisions, during and post-lockdown.

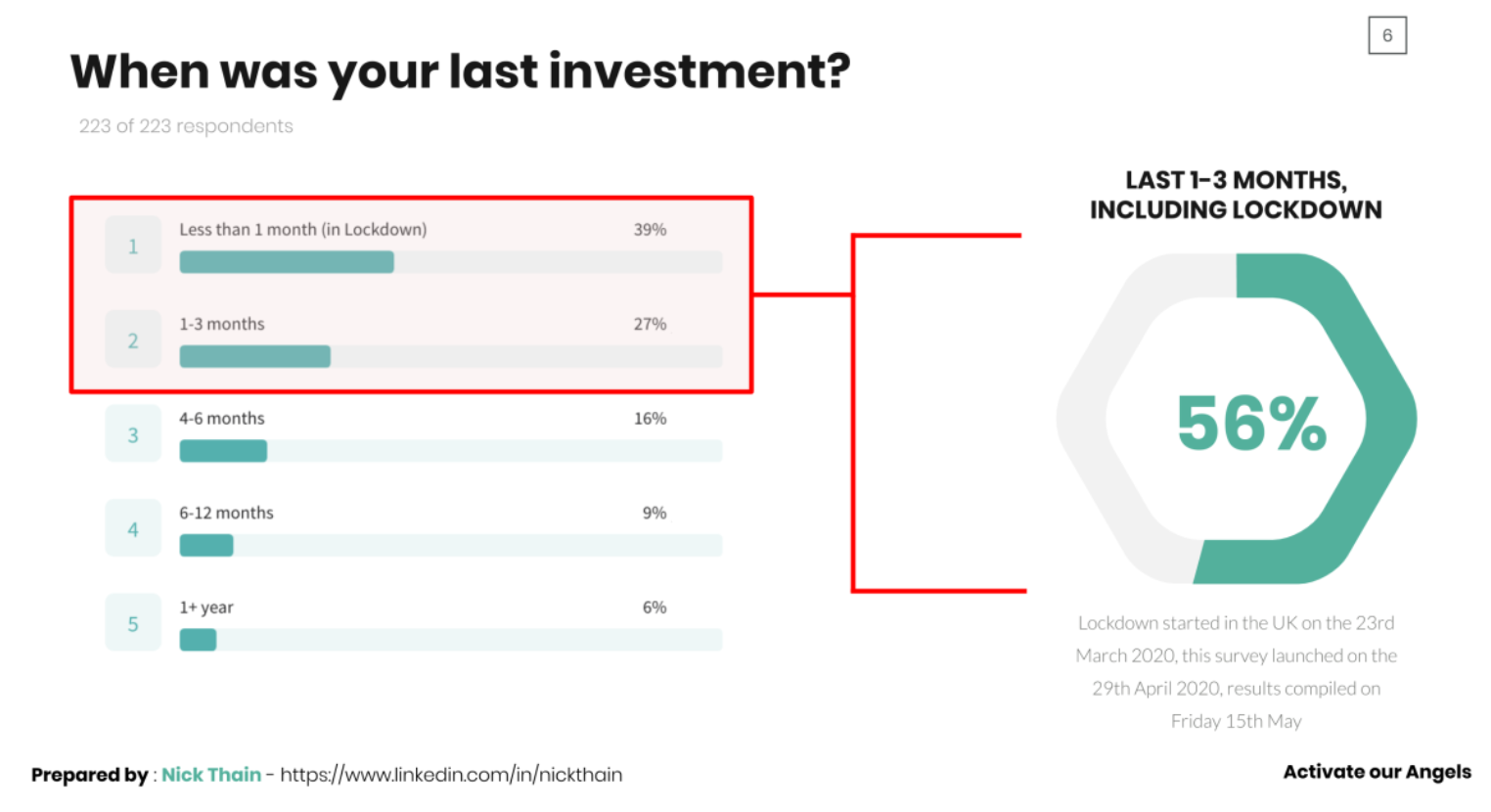

The survey shows that while angels are currently investing, founders will need to lock this funding down fast, as 59% of Angels surveyed says their future investing will be negatively affected the longer the lockdown goes on.

This becomes more important if a startup has raised under £250,000.

Furthermore, the survey concluded that Angels are investing 18% more per deal and have increased the frequency of deals in Lockdown by over 122% from 0.27 deals per month in 2019 to 0.6 deals per month in the last 3 months.

Angels are looking for increased runway and revenue generative businesses, and they’re seeing reduced valuations and smaller rounds.

Additionally, Angels are told the survey that they have 61% of the capital to invest in 2020 compared to 2019. This suggests that Angels are “making hay while the lockdown-sun is shining” said the survey.

Consequently, Angels will have significantly less money for the rest of 2020.

For start-ups that have not raised yet, the findings suggest they should do their first round as soon as possible.

For start-ups who have already raised, this impending angel capital crunch makes initiatives such as the forthcoming government-backed Future Fund as important as ever, says the survey.

“If Angels are not investing in Lockdown, they are holding cash and waiting to be confident that Covid-19 is over. The best way to contact them is via an introduction/recommendation, email or linkedIn, not via Social Media,” it added.

The results from the survey have been summarised below.

● 66.7% of Angel investors are still investing during Lockdown

○ 77% of those are investing in new deals

○ 23% of those in existing portfolio deals

● 33.3% of Angels are not investing in Lockdown

○ 71% of those are reviewing deals

○ 29% of those are not investing at all

● 17.6% more is being invested per deal during Lockdown.

○ £23,071 invested per deal in Lockdown

○ £19,620 invested per deal in 2019

● Angels completed an average of 1.81 deals during Lockdown, Angels completed an average of 3.24 deals in the whole of 2019

○ 1 deal every 3-4 weeks (approx.), since Lockdown on 23rd March 2020

○ 1 deal approximately every 7-8 weeks (approx.), in last 1-3 months

○ 1 deal every 3-4 months (approx.) in last 4-12 months

○ 1 deal every 3-4 months (approx.) in 2019

● 58.1% of Angels believe that Covid-19 will have a negative impact on their ability to invest in 2020, 27.2% No Change and 14.7% said it would have a positive impact

● 51.4% of Angels surveyed said they would be investing Less in 2020

○ of those Angels said they would invest 61% less capital in 2020 compared to

2019.

● 33.3% of Angels are not investing in Lockdown

○ of those 47.6% are only going to invest again when they are confident Covid-

19 crisis is over

○ of those 28.6% are not planning to invest again.

● 64.9% of Angels are changing the business sectors they’re looking at including; Healthcare, Fintech and gaming

● 54.1% of Angels have changed their investment requirements, with longer runway, revenue generative and recurring revenue being the most important factors.

○ 46.9% of Angels had no change in investment requirements

● 68% of Angels have seen deal terms with reduced valuations as a result of Covid-19 and 35% have seen smaller Investment rounds.

● When it comes to getting in contact with Angels, 72% want to be contacted via recommendations/introductions.

○ 54% via email

○ 32.6% LinkedIn

○ 30.9% Angel network.

○ Facebook and Twitter being the least effective way to contact angels with

less than 3% of respondents selecting this.

● 70% of Angels said SEIS/EIS was important, very important or critical to their investment decisions, of those 58% said they would not invest more if the SEIS allowance was increased to the £200k from the current £100k cap.