Is there a point when investors will turn off the spigots for giant unicorn funding rounds? If so, we haven’t reached that threshold yet.

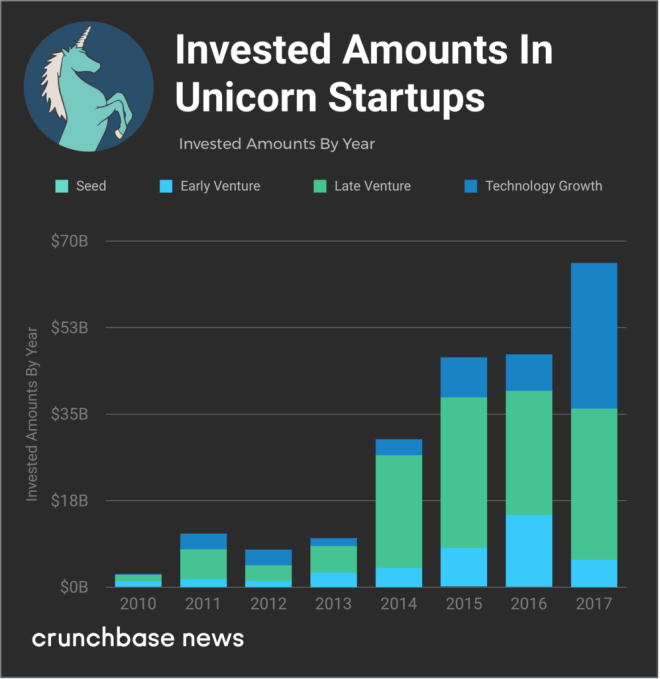

Last year, investors put a record amount of capital into members of the Crunchbase Unicorn Leaderboard, a list of private venture-backed companies valued at more than $1 billion.

Globally, a staggering $66 billion went into unicorn companies in 2017, up 39 percent year-over-year, according to an analysis of Crunchbase data. The ride-hailing space was the single largest recipient of investor dollars, with several rivals in the space raising billions. Investors also poured copious sums into co-working, consumer internet and augmented reality.

Newcomers also joined the unicorn club for the first time in 2017, albeit at a slightly slower pace than the preceding two years. For all of 2017, 60 new startups were added to the unicorn list. This compares to 66 newly minted unicorns in 2016 and the record-setting 2015 with 99 newcomers.

Below, we break down the leading locations for new and existing unicorns, top sectors for investment capital, exits and a few other trends affecting the space.

Geographic breakdown

The vast majority of unicorns are headquartered in either the U.S. or China, and that’s also the case for newcomers to the Unicorn Leaderboard.

In 2017, both the U.S. and China continued to mint new unicorns at a steady clip. A total of 29 U.S. companies inked their first funding round at a valuation of a billion dollars or more, up from 22 the prior year. In China, 24 new unicorns joined the leaderboard, down from 32 in 2016. Europe and Southeast Asia, meanwhile, also contributed a few unicorns.

In the chart below, we look at new entrants, categorized by country:

The newcomers were a pretty diverse bunch, spanning industries from agtech to enterprise software, including no-cost stock buying platform Robinhood, online education provider VIPKID and cryptocurrency buying and selling platform Coinbase.

Sectors

Unicorn investors showed a particularly strong appetite, however, for companies in a handful of sectors.

Ridesharing, in particular, had a strong funding year, with companies in the space taking more than 10 percent of all unicorn investment. That was largely attributable to billion and multi-billion dollar rounds for Lyft, Grab, Ola and Didi Chuxing.

Bike-sharing was also big. Two new entrants onto the unicorn list came from that space: Ofo and Mobike. However, concerns arose later in the year over whether consumer demand could support the ballooning bike supply.

Other recipients of really substantial funding rounds, even by unicorn standards, include U.S. co-working giant WeWork and China-based consumer internet players Toutiao and Koubei.

Exiting the board

So a lot of unicorns are raising big rounds. But is there any sign members of the group will eventually produce returns for investors?

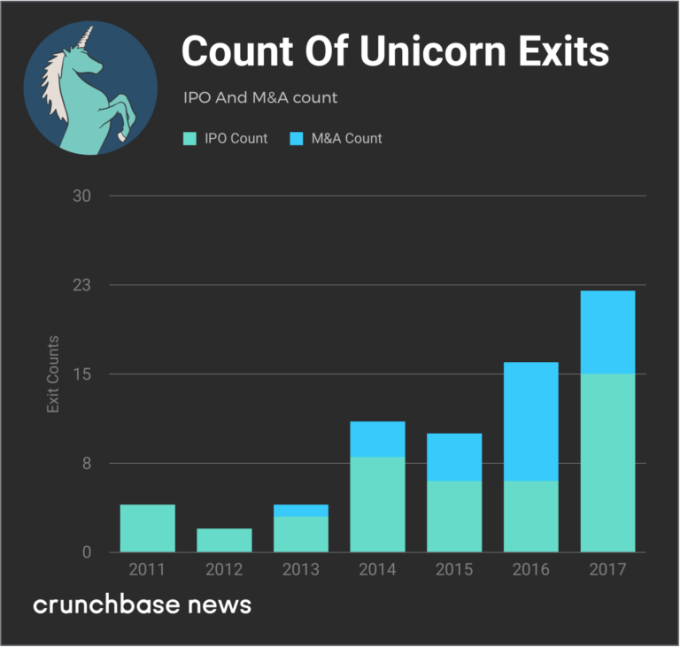

Overall, 2017 provided some modestly positive news for unicorn exit watchers. Fifteen venture-funded companies with private valuations of a billion dollars or more went public last year, more than double 2016 levels and the highest total since Crunchbase began tracking the asset class.

Acquisition activity, meanwhile, was weaker. There were just seven recorded M&A exits involving unicorns in 2017, down from 10 in 2016. AppDynamics was the highest-performing exit at 95 percent over its last private valuation. For the remaining companies that exited, all appear to have been below or at their last private valuation.

In the chart below, we look at IPO and M&A counts for unicorns over the past seven years:

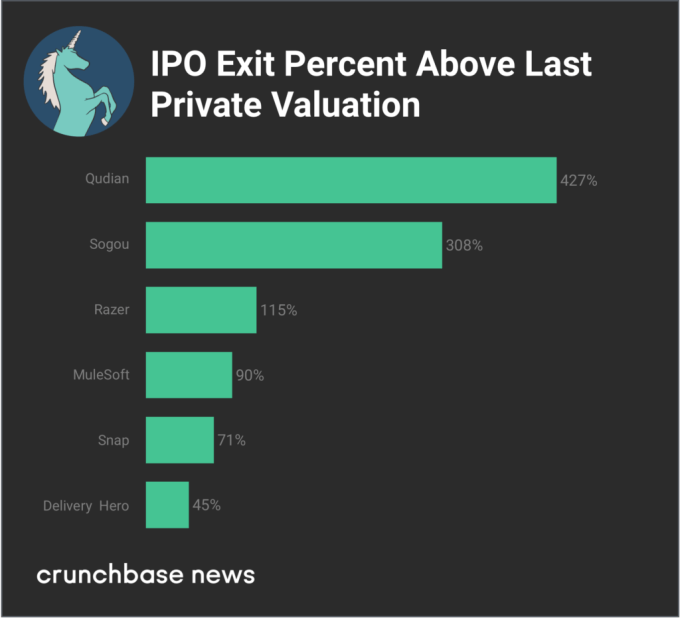

Unicorn IPOs weren’t just more common in 2017. Performance was often quite good, too. Many of last year’s newly public companies sustained market caps far higher than their last private valuations. Top performers by this metric include several China-based unicorns, led by investment manager Qudian and search engine Sogou. Other standouts include gaming hardware provider Razer and app developer software provider MuleSoft.

In the chart below, we look at some of the top performers based on the post-IPO percentage gains over their last private valuations:

Lately, going public seems to be a better option for investor returns. If the company goes out below its last private valuation, that multiple can improve if it grows its market and public shareholders boost the stock. For an M&A transaction, the price is set and either late-stage investors have built in protections or are losing money at those exit prices.

Averages point to more exits ahead

For the 45 unicorn companies that have gone public, the average time to go public has been 26 months after first being valued at $1 billion. For the 25 companies that have been acquired, the average time to get acquired is 24 months after first being valued at $1 billion.

So what does that say about the current crop of still-private companies? Because more than 150 companies out of 263 have been on the Unicorn Leaderboard for more than two years, we expect exits to increase, given the backlog.

Special thanks to Steven Rossi who manages the Crunchbase Unicorn Leaderboard.

Featured Image: Li-Anne Dias